Page 133 - Annual Report 2019-20

P. 133

Notes forming part of the financial statements Notes forming part of the financial statements 131

( in crores) ( in crores)

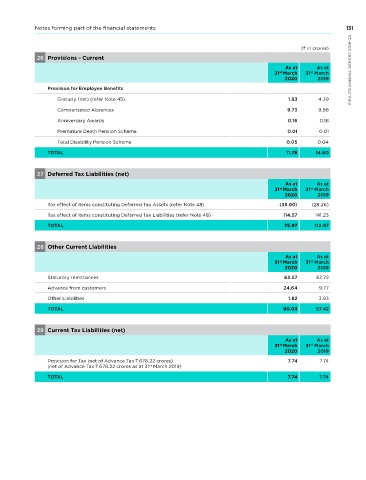

22 Trade Payables 26 Provisions - Current

As at As at As at As at

st

31 March 31 March 31 March 31 March PIDILITE ANNUAL REPORT 2019-20

st

st

st

2020 2019 2020 2019

Trade Payables Provision for Employee Benefits

Total outstanding dues of micro enterprises and small enterprises (refer note 50) 9.30 20.96 Gratuity (net) (refer note 45) 1.83 4.39

Total outstanding dues of creditors other than micro enterprises and small enterprises 485.51 428.19 Compensated Absences 9.73 9.98

TOTAL 494.81 449.15 Anniversary Awards 0.16 0.18

Premature Death Pension Scheme 0.01 0.01

23 other Financial Liabilities - Non-Current

Total Disability Pension Scheme 0.05 0.04

As at As at

st

st

31 March 31 March TOTAL 11.78 14.60

2020 2019

Employee related liabilities 0.47 0.82

27 Deferred Tax Liabilities (net)

Derivative liability towards put option to buy subsidiary shares - 42.20

As at As at

Others* 6.79 2.99 31 March 31 March

st

st

2020 2019

TOTAL 7.26 46.01

Tax effect of items constituting Deferred Tax Assets (refer note 48) (38.60) (28.26)

* Includes retention payable on capital goods

Tax effect of items constituting Deferred Tax Liabilities (refer note 48) 114.57 141.23

24 other Financial Liabilities- Current TOTAL 75.97 112.97

As at As at

st

st

31 March 31 March

2020 2019 28 other Current Liabilities

unclaimed Dividend 3.25 1.85 As at As at

31 March 31 March

st

st

Payables on purchase of assets 6.35 6.55 2020 2019

Trade/ Security Deposit received 123.86 109.89 Statutory remittances 63.57 43.72

Liabilities for expenses 349.78 289.51 Advance from customers 24.64 9.77

Employee related liabilities 18.43 22.20 Other Liabilities 1.82 3.93

Derivative liabilities towards Foreign Exchange Forward Contracts 0.42 0.96 TOTAL 90.03 57.42

Derivative liability towards put option to buy subsidiary shares 34.83 -

Others* 15.50 9.89 29 Current Tax Liabilities (net)

TOTAL 552.42 440.85 As at As at

31 March 31 March

st

st

* Includes retention payable on capital goods

2020 2019

25 Provisions - Non-Current Provision for Tax (net of Advance Tax 678.22 crores) 7.74 7.74

(net of Advance Tax 678.22 crores as at 31 March 2019)

st

As at 31 March TOTAL 7.74 7.74

As at

31 March

PIDILITE ANNUAL REPORT 2019-20 Provision for Employee Benefits 38.20 31.91

st

st

2019

2020

Compensated Absences

1.03

Anniversary Awards

0.82

1.55

Premature Death Pension Scheme

1.34

Total Disability Pension Scheme

0.27

0.32

130 TOTAL 40.89 34.55