Page 139 - Annual Report 2019-20

P. 139

Notes forming part of the financial statements Notes forming part of the financial statements 137

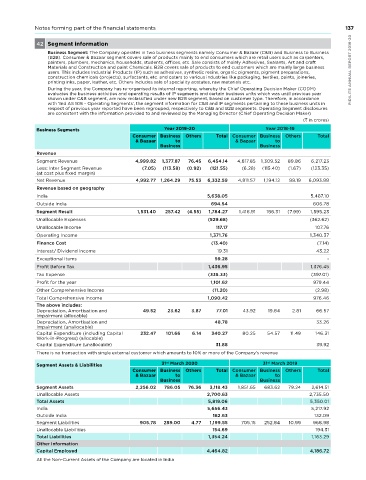

42 Segment information

( in crores)

Business Segment: The Company operates in two business segments namely Consumer & Bazaar (C&B) and Business to Business

39 Contingent Liabilities and Commitments (B2B). Consumer & Bazaar segment covers sale of products mainly to end consumers which are retail users such as carpenters,

painters, plumbers, mechanics, households, students, offices, etc. Sale consists of mainly Adhesives, Sealants, Art and craft

As at As at Materials and Construction and paint Chemicals. B2B covers sale of products to end customers which are mainly large business

31 March 31 March users. This includes Industrial Products (IP) such as adhesives, synthetic resins, organic pigments, pigment preparations, PIDILITE ANNUAL REPORT 2019-20

st

st

2020 2019 construction chemicals (projects), surfactants, etc. and caters to various industries like packaging, textiles, paints, joineries,

printing inks, paper, leather, etc. Others includes sale of speciality acetates, raw materials etc.

A) Contingent liabilities not provided for: During the year, the Company has re-organised its internal reporting, whereby the Chief Operating Decision Maker (CODM)

1. Claims against the Company not acknowledged as debts comprise: evaluates the business activities and operating results of IP segments and certain business units which was until previous year

shown under C&B segment, are now reclassified under new B2B segment, based on customer type. Therefore, in accordance

a) Income Tax demand against the Company not provided for and relating to issues of 58.50 30.57 with ‘Ind AS 108 – Operating Segments’, the segment information for C&B and IP segments pertaining to these business units in

deduction and allowances in respect of which the Company is in appeal respect of previous year reported have been regrouped, respectively to C&B and B2B segments. Operating Segment disclosures

are consistent with the information provided to and reviewed by the Managing Director (Chief Operating Decision Maker)

b) Excise Duty and Service Tax claims disputed by the Company relating to issues of 22.13 12.18 ( in crores)

classifications

c) Sales Tax (VAT, CST, Entry Tax and GST) claims disputed by the Company relating to 165.92 176.25 Business Segments Year 2019-20 Year 2018-19

issues of declaration forms and classifications Consumer Business others Total Consumer Business Others Total

to

to

d) Other Matters (relating to disputed Electricity Duty, Gram Panchayat Tax, Open Access 3.14 3.22 & Bazaar Business & Bazaar Business

Charges, etc.)

2. a) Guarantees given by Banks on behalf of Government and others* 47.86 48.86 Revenue

Segment Revenue 4,999.82 1,377.87 76.45 6,454.14 4,817.85 1,309.52 89.86 6,217.23

b) Guarantees given by Company on behalf of the Subsidiaries to Banks*

Less: Inter Segment Revenue (7.05) (113.58) (0.92) (121.55) (6.28) (115.40) (1.67) (123.35)

Pulvitec do Brasil Industria e Comercio de Colas e Adesivos Ltda 25.64 16.60 (at cost plus fixed margin)

net Revenue 4,992.77 1,264.29 75.53 6,332.59 4,811.57 1,194.12 88.19 6,093.88

Pidilite Bamco Ltd 3.24 2.97

Revenue based on geography

Pidilite MEA Chemicals LLC (Previously known as Jupiter Chemicals LLC) 41.07 37.67

India 5,638.05 5,487.10

Pidilite Lanka Private Limited 33.15 30.40

Outside India 694.54 606.78

Bamco Supply & Services Ltd 1.09 1.00

Segment Result 1,531.40 257.42 (4.55) 1,784.27 1,416.91 186.31 (7.99) 1,595.23

* Guarantees given are for business purpose. unallocable Expenses (529.68) (362.62)

note: The Company, being the holding/ultimate holding company, will extend financial support to unallocable Income 117.17 107.76

its subsidiaries as and when required.

Operating Income 1,371.76 1,340.37

B) Commitments: Finance Cost (13.40) (7.14)

Interest/ Dividend Income 19.31 43.22

a) Estimated amount of contracts, net of advances, remaining to be executed for the 204.00 68.20

acquisition of Property, Plant and Equipment, investments and not provided for Exceptional Items 59.28 -

b) For other commitments, refer note 47(E)(ii) for financial instruments, note 51 for leases Profit Before Tax 1,436.95 1,376.45

and note 53 (a)(i) & note 54 for committed investment in subsidiaries. Tax Expense (335.33) (397.01)

c) The Supreme Court in a earlier judgement has held that provident fund contributions are

payable on basic wage, dearness allowances and all other monthly allowances, which Profit for the year 1,101.62 979.44

are universally, necessarily and ordinarily paid to all the employees in the establishment Other Comprehensive Income (11.20) (2.98)

across the board. There are numerous interpretative issues relating to the judgement. As Total Comprehensive Income 1,090.42 976.46

such, the Company has, based on legal advice and as a matter of caution, made provision

for an estimated amount on a prospective basis. The above includes:

The net amount of exchange differences debited to Statement of Profit and Loss is 1.86 crores ( 6.32 crores for the year Depreciation, Amortisation and 49.52 23.62 3.87 77.01 43.92 19.84 2.81 66.57

40 ended 31 March 2019) Impairment (allocable) 48.78 33.26

st

Depreciation, Amortisation and

Impairment (unallocable)

41 Disclosure as per Regulation 34(3) read with Schedule 5 of Listing Regulations with the Stock Exchanges Capital Expenditure (including Capital 232.47 101.66 6.14 340.27 80.25 54.57 11.49 146.31

Work-in-Progress) (allocable)

a) Loans and Advances in the nature of loans given to subsidiaries, associates, firms/ companies in which directors

are interested: Capital Expenditure (unallocable) 31.88 39.92

There is no transaction with single external customer which amounts to 10% or more of the Company’s revenue

Name of the Company As at 31 March 2020 As at 31 March 2019

st

st

st

st

Relationship Amount Maximum Amount Maximum Segment Assets & Liabilities 31 March 2020 31 March 2019

Total

Total

outstanding outstanding Outstanding Segment Assets Consumer Business others 3,118.43 Consumer Business Others 2,614.51

Balance Outstanding

Balance

& Bazaar

to

& Bazaar

to

PIDILITE ANNUAL REPORT 2019-20 Pagel Concrete Technologies Pvt Ltd Subsidiary 0.33 0.33 0.33 0.33 unallocable Assets 905.78 289.00 4.77 2,700.63 705.15 252.84 10.99 2,735.50

Business

Business

during

during

2,256.02

683.62

76.36

786.05

1,851.65

79.24

the year

the year

5,819.06

Total Assets

5,350.01

5,217.92

India

5,656.43

Notes:

Outside India

132.09

162.63

Loans and Advances shown above, fall under the category of ‘Loans & Advances’ in the nature of loans where there

a)

1,199.55

Segment Liabilities

968.98

is no repayment schedule and re-payable on demand.

154.69

unallocable Liabilities

194.31

1,354.24

1,163.29

Other Information

Capital Employed

136 b) Loans and Advances referred above are not bearing any interest and are fully provided. Total Liabilities 4,464.82 4,186.72

All the non-Current Assets of the Company are located in India