Page 67 - Annual Report 2019-20

P. 67

ANNExuRE 4 TO ThE DIRECTORS’ REPORT 65

Disclosure regarding Employee Stock Option of the Company for the year ended 31 March 2020

st

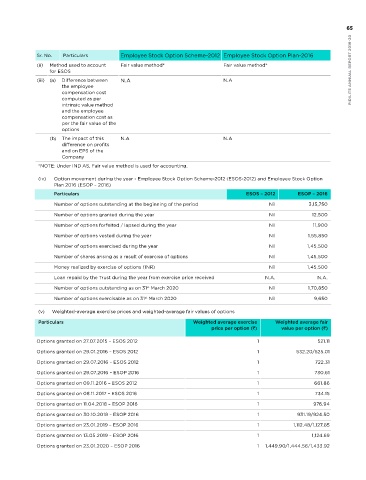

Sr. No. Particulars Employee Stock Option Scheme-2012 Employee Stock Option Plan-2016

A. Relevant disclosures in terms of the ‘Guidance note on accounting for employee share-based payments’ (ii) Method used to account Fair value method* Fair value method*

issued by ICAI or any other relevant accounting standards as prescribed from time to time. Members may for ESOS PIDILITE ANNUAL REPORT 2019-20

refer to the audited financial statement prepared as per Indian Accounting Standard (Ind-AS) for the

year 2019-20. (iii) (a) Difference between N.A N.A

the employee

B. Diluted EPS on issue of shares pursuant to all the schemes covered under the regulations shall be disclosed compensation cost

in accordance with ‘Accounting Standard 20 - Earnings Per Share’ issued by ICAI or any other relevant computed as per

accounting standards as prescribed from time to time. Diluted EPS for the year ended 31 March 2020 is intrinsic value method

st

21.68 calculated in accordance with Ind-AS 33 (Earnings per Share). and the employee

compensation cost as

per the fair value of the

C. Details related to Employees’ Stock option of the Company for the year ended 31 March 2020:

st

options

(i) (b) The impact of this N.A N.A

difference on profits

Sr. No. Particulars Employee Stock Option Scheme-2012 Employee Stock Option Plan-2016 and on EPS of the

Company

(a) Date of shareholders’ 24.07.2012 02.04.2016

approval *NOTE: Under IND AS, Fair value method is used for accounting.

(b) Total number of options 3,00,000 45,00,000 (iv) Option movement during the year - Employee Stock Option Scheme-2012 (ESOS-2012) and Employee Stock Option

approved under ESOS Plan 2016 (ESOP – 2016)

(c) Vesting requirements (a) On completion of 50% of the Options granted under the Plan shall vest Particulars ESOS – 2012 ESOP – 2016

12 months from the options not earlier than One year but not later than a

date of Grant maximum of Six years from the date of grant Number of options outstanding at the beginning of the period Nil 3,15,750

(b) On completion of Balance 50% of of such Options. Number of options granted during the year Nil 12,500

24 months from the the options In the case of Eligible Employee who has

date of Grant Number of options forfeited / lapsed during the year Nil 11,900

not completed 3 years of employment as

In the case of employees who have not on date of the grant of Options then the Number of options vested during the year Nil 1,55,850

completed 3 years of employment as on Options which are due for Vesting before Number of options exercised during the year Nil 1,45,500

date of the grant then all options which are completion of 3 years as above, shall vest as

due for Vesting shall vest as per (a) and on the completion of 3 years of employment Number of shares arising as a result of exercise of options Nil 1,45,500

(b) above OR on the completion of 3 years in the Company by the Employee concerned

of employment in the Company by the or as may be approved by the Compensation Money realized by exercise of options (INR) Nil 1,45,500

employee concerned whichever is later. Committee. Loan repaid by the Trust during the year from exercise price received N.A. N.A.

The Compensation Committee in its Number of options outstanding as on 31 March 2020 Nil 1,70,850

st

absolute discretion shall have the right to

st

pre-pone the date of vesting. However the Number of options exercisable as on 31 March 2020 Nil 9,650

gap between the date of Grant and date

of Vesting shall not be less than minimum (v) Weighted-average exercise prices and weighted-average fair values of options

period prescribed by the Securities and Particulars Weighted average exercise Weighted average fair

Exchange Board of India. price per option ( ) value per option ( )

(d) Exercise price or As approved by the Shareholders in As approved by the Shareholders through Options granted on 27.07.2015 – ESOS 2012 1 521.11

pricing formula the Annual General Meeting held on Postal Ballot which was declared on 2 April

nd

th

24 July 2012, the exercise price shall be 2016, the exercise price shall be 1/- per Options granted on 29.01.2016 – ESOS 2012 1 532.20/525.01

1/- per option. The exercise price of the option. Options granted on 29.07.2016 – ESOS 2012 1 722.31

options granted till date is 1/- per option. The exercise price of the options granted till

730.61

date is 1/- per option. Options granted on 29.07.2016 – ESOP 2016 1 1 661.86

PIDILITE ANNUAL REPORT 2019-20 (f) Source of shares been granted in the year 2019-20. options need to be exercised within a Options granted on 08.11.2017 – ESOS 2016 1 1 1 1 1,112.48/1,127.85

All the options granted have been vested

Out of the options granted, the last date

Maximum term of

(e)

Options granted on 09.11.2016 – ESOS 2012

and have been exercised. No options have of vesting is 23 January 2024. The vested

options granted

rd

734.15

maximum period of three years from the

976.94

Options granted on 11.04.2018 – ESOP 2016

date of vesting of such options.

931.19/924.50

Options granted on 30.10.2018 – ESOP 2016

Primary

Primary

Options granted on 23.01.2019 – ESOP 2016

(primary, secondary or

combination)

1,124.69

(g)

Variation in terms

Options granted on 23.01.2020 – ESOP 2016

of options Not Applicable Not Applicable Options granted on 13.05.2019 – ESOP 2016 1 1 1,449.90/1,444.56/1,433.92

64