Page 85 - Annual Report 2019-20

P. 85

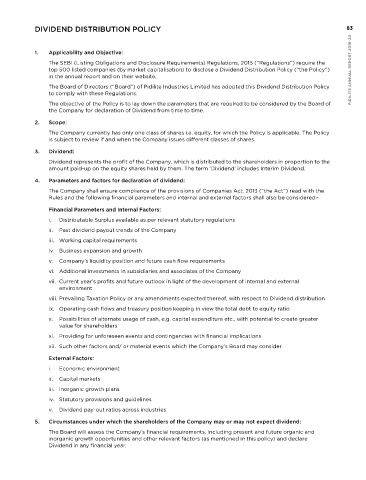

ANNExuRE 6 TO ThE DIRECTORS’ REPORT DIVIDEND DISTRIBuTION POLICY 83

Information required under Section 197 of the Companies Act, 2013 read with Companies (Appointment and 1. Applicability and Objective:

Remuneration of Managerial Personnel) Rules, 2014

The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“Regulations”) require the

A. Ratio of remuneration paid to each Director to the median remuneration of the employees of the top 500 listed companies (by market capitalisation) to disclose a Dividend Distribution Policy (“the Policy”) PIDILITE ANNUAL REPORT 2019-20

Company and percentage increase in remuneration for the financial year 2019-20 is as follows: in the annual report and on their website.

The Board of Directors (“Board”) of Pidilite Industries Limited has adopted this Dividend Distribution Policy

Sr. Name of Director Designation Ratio of remuneration % increase

No. of Director to the to comply with these Regulations.

Median remuneration The objective of the Policy is to lay down the parameters that are required to be considered by the Board of

1 Shri M B Parekh Executive Chairman 74.07 4.12% the Company for declaration of Dividend from time to time.

2 Shri N K Parekh Vice Chairman 4.91 (3.17%)

2. Scope:

3 Shri Bharat Puri Managing Director 569.82 23.30%

4 Shri A B Parekh Whole time Director 118.99 3.73% The Company currently has only one class of shares i.e. equity, for which the Policy is applicable. The Policy

is subject to review if and when the Company issues different classes of shares.

5 Shri A N Parekh Whole time Director 101.30 4.46%

6 Shri B S Mehta Director 4.27 (5.91%) 3. Dividend:

7 Shri Sanjeev Aga Director 4.50 2.44% Dividend represents the profit of the Company, which is distributed to the shareholders in proportion to the

8 Shri Uday Khanna Director 4.21 (2.48%) amount paid-up on the equity shares held by them. The term ‘Dividend’ includes Interim Dividend.

9 Smt Meera Shankar Director 3.95 (1.34%) 4. Parameters and factors for declaration of dividend:

10 Shri Sabyaschi Patnaik * Whole time Director 47.98 3.11%

The Company shall ensure compliance of the provisions of Companies Act, 2013 (“the Act”) read with the

11 Shri Vinod Kumar Dasari Director 3.95 1.38% Rules and the following financial parameters and internal and external factors shall also be considered:-

12 Shri Piyush Pandey Director 3.89 2.84%

13 Shri Debabrata Gupta Whole time Director - ~ Financial Parameters and Internal Factors:

i. Distributable Surplus available as per relevant statutory regulations

B. Percentage increase in remuneration of Company Secretary and Chief Financial Officer for the financial

year 2019-20 is as follows: ii. Past dividend payout trends of the Company

iii. Working capital requirements

Sr. Name Designation % increase

No. iv. Business expansion and growth

1 Shri P. Ganesh Chief Financial Officer ^

v. Company’s liquidity position and future cash flow requirements

2 Shri Pradip Menon Chief Financial Officer ^

vi. Additional investments in subsidiaries and associates of the Company

3 Shri Puneet Bansal Company Secretary #

vii. Current year’s profits and future outlook in light of the development of internal and external

Notes:

1. The aforesaid details are calculated on the basis of remuneration paid during the financial year 2019-20. environment

2. The remuneration to Non Executive Directors comprises of sitting fees and commission paid to them during the financial year 2019-20. viii. Prevailing Taxation Policy or any amendments expected thereof, with respect to Dividend distribution

3. The median remuneration is 5,60,004/- for the financial year 2019-20.

4. * Shri Sabyaschi Patnaik was the Whole Time Director of the Company upto 29 February 2020. ix. Operating cash flows and treasury position keeping in view the total debt to equity ratio

th

5. ~ % increase in remuneration is not given as Shri Debabrata Gupta was appointed as the Whole Time Director of the Company

st

w.e.f. 1 March 2020. x. Possibilities of alternate usage of cash, e.g. capital expenditure etc., with potential to create greater

6. ^ % increase in remuneration is not given as the payment for the financial year 2019-20 was only for part of the year. value for shareholders

7. # % increase in remuneration is not given as the payment for financial year 2018-19 was only for part of the year. xi. Providing for unforeseen events and contingencies with financial implications

8. The remuneration to Directors is within the overall limits approved by the shareholders.

xii. Such other factors and/ or material events which the Company’s Board may consider

C. Percentage increase in the median remuneration of employee in the financial year 2019-20: 7.60%

External Factors:

D. Number of permanent employees on the rolls of the Company as on 31 March 2020: 6,064

st

i. Economic environment

E. Average percentage increase already made in the salaries of employees other than the managerial ii. Capital markets

PIDILITE ANNUAL REPORT 2019-20 F. increase in the managerial remuneration: 5. iv. Statutory provisions and guidelines

personnel in the last financial year and its comparison with the percentage increase in the managerial

remuneration and justification thereof and point out if there are any exceptional circumstances for

iii. Inorganic growth plans

Increase in remuneration is based on Remuneration Policy of the Company.

v. Dividend pay-out ratios across industries

Average increase in salary of all employees in 2019-20 compared to 2018-19: 11.38%

Circumstances under which the shareholders of the Company may or may not expect dividend:

Affirmation:

inorganic growth opportunities and other relevant factors (as mentioned in this policy) and declare

Rules, 2014, it is affirmed that the remuneration paid to the Directors, Key Managerial Personnel and senior

Dividend in any financial year.

Management is as per the Remuneration Policy of the Company.

82 Pursuant to Rule 5(1)(xii) of the Companies (Appointment and Remuneration of Managerial Personnel) The Board will assess the Company’s financial requirements, including present and future organic and