Page 122 - Annual Report 2019-20

P. 122

notes forming part of the financial statements notes forming part of the financial statements 121

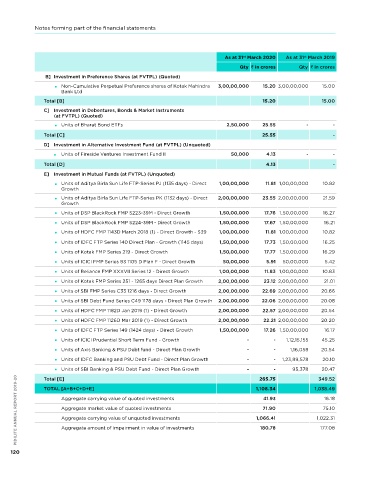

As at 31 March 2020 As at 31 March 2019 8 Investments - Current

st

st

Qty in crores Qty in crores As at 31 March 2020 As at 31 March 2019 PIDILITE ANNUAL REPORT 2019-20

st

st

B] Investment in Preference Shares (at FVTPL) (Quoted) Qty in crores Qty in crores

non-Cumulative Perpetual Preference shares of Kotak Mahindra 3,00,00,000 15.20 3,00,00,000 15.00 Current Investments

Bank Ltd

A] Investment in Debentures, Bonds & Market Instruments (at FVTPL)

Total [B] 15.20 15.00 (Quoted)

C] Investment in Debentures, Bonds & Market Instruments Tax-free bonds of housing and urban Development 2,00,000 21.27 2,00,000 21.04

(at FVTPL) (Quoted) Corporation Ltd

units of Bharat Bond ETFs 2,50,000 25.55 - - Tax-free bonds of national housing Bank 10,000 5.59 10,000 5.48

Total [C] 25.55 - Tax-free bonds of Indian Railway Finance Corporation 12 Feb 22 70,000 7.57 70,000 7.56

Tax-free bonds of Indian Railway Finance Corporation 11 Jan 26 1,000 10.40 1,000 10.39

D] Investment in Alternative Investment Fund (at FVTPL) (Unquoted)

Secured, redeemable, non-convertible debentures of Citicorp - - 2,500 26.59

units of Fireside Ventures Investment Fund II 50,000 4.13 - - Finance (India) Ltd

Total [D] 4.13 - Secured, redeemable non-convertible debentures of hDB - - 250 30.38

Financial services

E] Investment in Mutual Funds (at FVTPL) (Unquoted)

TOTAL [A] 44.83 101.44

units of Aditya Birla Sun Life FTP-Series PJ (1135 days) - Direct 1,00,00,000 11.81 1,00,00,000 10.82

Growth B] Investment in Mutual Funds (at FVTPL) (Unquoted)

units of Aditya Birla Sun Life FTP-Series PK (1132 days) - Direct 2,00,00,000 23.55 2,00,00,000 21.59 units of hDFC Overnight Fund - Direct Growth 6,79,896 201.88 1,68,854 47.66

Growth

units of SBI Overnight Fund - Direct Plan Growth 6,46,655 210.40 1,60,785 49.72

units of DSP BlackRock FMP S223-39M - Direct Growth 1,50,00,000 17.76 1,50,00,000 16.27

units of Aditya Birla Sun Life Overnight Fund - Direct Growth 9,22,816 99.70 - -

units of DSP BlackRock FMP S224-39M - Direct Growth 1,50,00,000 17.67 1,50,00,000 16.21

units of ICICI Overnight Fund - Direct Growth 1,46,98,077 158.37 - -

units of hDFC FMP 1143D March 2018 (1) - Direct Growth - S39 1,00,00,000 11.81 1,00,00,000 10.82

units of IDFC Corporate Bond Fund - Direct Plan - Growth - - 4,81,11,596 61.87

units of IDFC FTP Series 140 Direct Plan - Growth (1145 days) 1,50,00,000 17.73 1,50,00,000 16.25 units of Reliance Banking & PSu Debit Fund - Direct Growth Plan - - 5,52,03,331 75.05

units of Kotak FMP Series 219 - Direct Growth 1,50,00,000 17.77 1,50,00,000 16.29 units of SBI Short Term Debt Fund - Direct Plan - Growth - - 2,67,44,404 58.92

units of ICICI FMP Series 83 1105 D Plan F - Direct Growth 50,00,000 5.91 50,00,000 5.42 units of ICICI Prudential Equity Arbitrage Fund - Direct Plan - - 6,02,48,585 87.31

Dividend - DR

units of Reliance FMP XXXVII Series 12 - Direct Growth 1,00,00,000 11.83 1,00,00,000 10.83

units of Kotak Equity Arbitrage Fund - Direct Plan - - 3,92,78,155 92.46

units of Kotak FMP Series 251 - 1265 days Direct Plan Growth 2,00,00,000 23.12 2,00,00,000 21.01 Fortnightly Dividend

units of SBI FMP Series C33 1216 days - Direct Growth 2,00,00,000 22.69 2,00,00,000 20.66 units of Kotak Savings Fund - Direct Plan Growth - - 3,63,21,092 110.97

units of SBI Debt Fund Series C49 1178 days - Direct Plan Growth 2,00,00,000 22.06 2,00,00,000 20.08 units of Aditya Birla Sun Life Banking & PSu Debt Fund - - - 15,28,949 36.99

Direct Growth

units of hDFC FMP 1182D Jan 2019 (1) - Direct Growth 2,00,00,000 22.57 2,00,00,000 20.54

units of Aditya Birla Sun Life Corporate Bond Fund - Direct - - 64,44,650 46.49

units of hDFC FMP 1126D Mar 2019 (1) - Direct Growth 2,00,00,000 22.21 2,00,00,000 20.20 Plan Growth

units of IDFC FTP Series 149 (1424 days) - Direct Growth 1,50,00,000 17.26 1,50,00,000 16.17 units of Aditya Birla Sun Life Equity Arbitrage Fund - Direct - - 7,90,33,020 87.13

Dvd reinvst

units of ICICI Prudential Short Term Fund - Growth - - 1,12,15,155 45.25

units of Reliance Arbitrage Fund - Direct Dvd reinvst - - 6,98,70,243 90.08

units of Axis Banking & PSu Debt fund - Direct Plan Growth - - 1,16,058 20.54

units of hDFC Short Term Debt Fund - Direct Plan Growth - - 1,77,04,254 36.88

units of IDFC Banking and PSu Debt Fund - Direct Plan Growth - - 1,23,89,578 20.10 units of hDFC Corporate Bond Fund - Direct Plan Growth - - 2,31,55,787 48.48

20.47

-

units of SBI Banking & PSu Debt Fund - Direct Plan Growth - 1,108.34 95,378 1,038.49 units of ICICI Prudential Bond Fund - Direct Plan Growth - - 1,31,84,101 34.82

PIDILITE ANNUAL REPORT 2019-20 Aggregate carrying value of quoted investments 1,066.41 1,022.31 TOTAL [B] 670.35 1,049.95

349.52

265.75

Total [E]

- 4,33,00,226

units of ICICI Prudential Corporate Bond Fund - Direct

-

85.12

Plan Growth

TOTAL [A+B+C+D+E]

16.18

41.93

715.18

TOTAL [A]+[B]

1,151.39

71.90

75.10

Aggregate market value of quoted investments

101.44

44.83

Aggregate carrying value of quoted investments

Aggregate carrying value of unquoted investments

44.83

101.44

Aggregate market value of quoted investments

Aggregate amount of Impairment in value of investments

180.78

177.08

670.35

Aggregate carrying value of unquoted investments

1,049.95

120