Page 124 - Annual Report 2019-20

P. 124

Notes forming part of the financial statements Notes forming part of the financial statements 123

( in crores) ( in crores)

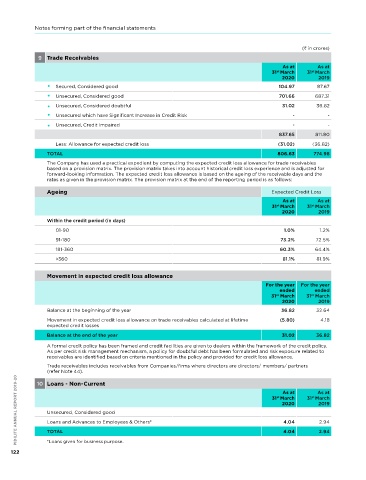

9 Trade Receivables 11 Loans - Current

As at As at As at As at

31 March 31 March 31 March 31 March PIDILITE ANNUAL REPORT 2019-20

st

st

st

st

2020 2019 2020 2019

Secured, Considered good 104.97 87.67 Loans and Advances to Related Parties* (refer note 44)

unsecured, Considered good 701.66 687.31 unsecured, Considered good 9.31 4.71

unsecured, Considered doubtful 31.02 36.82 Considered doubtful 0.33 0.33

unsecured which have Significant Increase in Credit Risk - - 9.64 5.04

unsecured, Credit Impaired - - Less: Allowance for doubtful balances (0.33) (0.33)

837.65 811.80 9.31 4.71

Less: Allowance for expected credit loss (31.02) (36.82) Loans and Advances to Employees & Others* 16.07 10.67

TOTAL 806.63 774.98 TOTAL 25.38 15.38

The Company has used a practical expedient by computing the expected credit loss allowance for trade receivables *Loans given for business purpose.

based on a provision matrix. The provision matrix takes into account historical credit loss experience and is adjusted for

forward-looking information. The expected credit loss allowance is based on the ageing of the receivable days and the

rates as given in the provision matrix. The provision matrix at the end of the reporting period is as follows: 12 other Financial Assets - Non-Current

As at As at

Ageing Expected Credit Loss 31 March 31 March

st

st

2020 2019

As at As at

31 March 31 March Security Deposit 13.12 10.90

st

st

2020 2019

Derivative Asset towards call option to buy subsidiary shares - 7.61

Within the credit period (in days)

Other Receivables

01-90 1.0% 1.2%

unsecured, Considered good - -

91-180 73.2% 72.5%

Considered doubtful 1.74 1.74

181-360 60.3% 64.4%

1.74 1.74

>360 81.1% 81.9%

Less: Allowance for doubtful balances (1.74) (1.74)

Movement in expected credit loss allowance - -

For the year For the year TOTAL 13.12 18.51

ended ended

st

31 March 31 March

st

2020 2019 13 other Financial Assets - Current

Balance at the beginning of the year 36.82 32.64 As at As at

31 March 31 March

st

st

Movement in expected credit loss allowance on trade receivables calculated at lifetime (5.80) 4.18 2020 2019

expected credit losses

Security Deposit

Balance at the end of the year 31.02 36.82

unsecured, Considered good 5.82 5.58

A formal credit policy has been framed and credit facilities are given to dealers within the framework of the credit policy.

As per credit risk management mechanism, a policy for doubtful debt has been formulated and risk exposure related to Considered doubtful 0.55 0.45

receivables are identified based on criteria mentioned in the policy and provided for credit loss allowance.

6.37 6.03

Trade receivables includes receivables from Companies/firms where directors are directors/ members/ partners

Less: Allowance for doubtful balances

(refer note 44). Derivative assets towards Foreign Exchange Forward Contracts (0.55) (0.45)

PIDILITE ANNUAL REPORT 2019-20 unsecured, Considered good 31 March 31 March Derivative Asset towards call option to buy subsidiary shares 0.24 3.64

5.58

5.82

10 Loans - Non-Current

1.70

0.03

As at

As at

-

st

st

2020

2019

Other Receivables*

0.47

9.25

8.23

TOTAL

Loans and Advances to Employees & Others*

2.94

4.04

*Includes Windmill income

*Loans given for business purpose.

122 TOTAL 4.04 2.94