Page 157 - Annual Report 2019-20

P. 157

Notes forming part of the financial statements Notes forming part of the financial statements 155

( in crores) ( in crores)

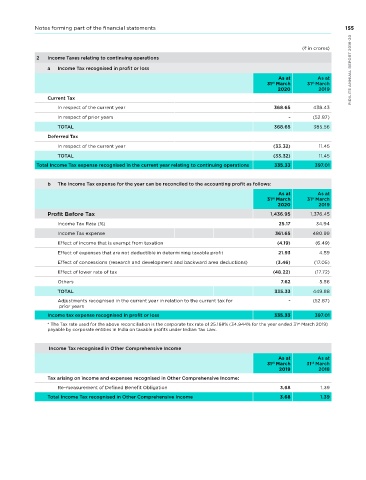

48 Taxes 2 Income Taxes relating to continuing operations

1 Deferred Tax a Income Tax recognised in profit or loss PIDILITE ANNUAL REPORT 2019-20

As at As at st As at st As at

31 March 31 March 31 March 31 March

st

st

2020 2019 2020 2019

Current Tax

Deferred Tax Assets (38.60) (28.26)

In respect of the current year 368.65 438.43

Deferred Tax Liabilities 114.57 141.23

In respect of prior years - (52.87)

TOTAL 75.97 112.97

TOTAL 368.65 385.56

a 2019- 2020 Deferred Tax

Deferred Tax (Assets)/ Liabilities in relation to : In respect of the current year (33.32) 11.45

Opening Recognised in Recognised Closing TOTAL (33.32) 11.45

Balance Profit or loss in Other balance Total Income Tax expense recognised in the current year relating to continuing operations 335.33 397.01

Comprehen-

sive Income

Property, Plant and Equipment 51.95 (33.87) - 18.08 b The Income Tax expense for the year can be reconciled to the accounting profit as follows:

As at As at

Intangible Assets 72.08 0.99 - 73.07 31 March 31 March

st

st

2020 2019

FVTPL Financial Assets 17.07 (12.84) - 4.23

Profit Before Tax 1,436.95 1,376.45

Provisions for VRS 0.12 (0.12) - -

Income Tax Rate (%) 25.17 34.94

Allowance for doubtful debts (12.86) 5.05 - (7.81)

Income Tax expense 361.65 480.99

Provision for Employee Benefits (14.99) 6.34 (3.68) (12.33) Effect of income that is exempt from taxation (4.19) (6.49)

Share issue and buy-back costs (0.40) 1.88 - 1.48 Effect of expenses that are not deductible in determining taxable profit 21.93 4.59

Effect of concessions (research and development and backward area deductions) (3.46) (17.05)

Others - (0.75) - (0.75)

Effect of lower rate of tax (48.22) (17.72)

TOTAL 112.97 (33.32) (3.68) 75.97

Others 7.62 5.56

b 2018- 2019

TOTAL 335.33 449.88

Deferred Tax (Assets)/ Liabilities in relation to: Adjustments recognised in the current year in relation to the current tax for - (52.87)

prior years

Property, Plant and Equipment 52.59 (0.64) - 51.95

Income tax expense recognised in profit or loss 335.33 397.01

Intangible Assets 63.80 8.28 - 72.08

* The Tax rate used for the above reconciliation is the corporate tax rate of 25.168% (34.944% for the year ended 31 March 2019)

st

payable by corporate entities in India on taxable profits under Indian Tax Law.

FVTPL Financial Assets 16.68 0.39 - 17.07

Provisions for VRS (2.49) 2.61 - 0.12

Income Tax recognised in Other Comprehensive Income

Allowance for doubtful debts (11.41) (1.46) - (12.86) As at As at

31 March 31 March

st

st

Provision for Employee Benefits (13.10) (0.50) (1.39) (14.99) Tax arising on income and expenses recognised in Other Comprehensive Income: 3.68 2018

2019

PIDILITE ANNUAL REPORT 2019-20 Total 102.90 11.45 (1.39) 112.97 Total Income Tax recognised in Other Comprehensive Income 3.68 1.39

2.77

(3.17)

Share issue and buy-back costs

-

(0.40)

1.39

Re-measurement of Defined Benefit Obligation

154