Page 154 - Annual Report 2019-20

P. 154

notes forming part of the financial statements notes forming part of the financial statements 153

(ii) Foreign exchange forward contracts The tables include both interest and principal cash flows. To the extent that interest flows are floating rate, the undiscounted

amount is derived from interest rate curves at the end of the reporting period. The contractual maturity is based on the earliest

It is the policy of the Company to enter into foreign exchange forward contracts to cover foreign currency payments (net date on which the Company will be liable to pay.

of receipts) in uSD and EuR. The Company enters in to contracts with terms upto 90 days. The Company’s philosophy ( in crores)

does not permit any speculative calls on the currency. It is driven by conservatism which guides that we follow conventional PIDILITE ANNUAL REPORT 2019-20

wisdom by use of Forward contracts in respect of Trade transactions. Less than 1-5 years More than 5 Total Carrying

Amount

years

1 year

Regulatory Requirements: The Company does alter its hedge strategy in relation to the prevailing regulatory framework

and guidelines that may be issued by RBI, FEDAI or ISDA or other regulatory bodies from time to time.

st

As at 31 March 2020

Mode of taking Cover: Based on the outstanding details of import payable and export receivable (in weekly baskets) the

net trade import exposure is arrived at (i.e. Imports – Exports = net trade exposures). The net trade import exposure Non-interest bearing

arrived at is netted off with the outstanding forward cover as on date and with the surplus foreign currency balance - Trade Payables 494.81 - - 494.81 494.81

available in EEFC A/Cs. Forward cover is obtained from bank for each of the aggregated exposures and the Trade deal is - Other Financial Liabilities 393.31 7.26 - 400.57 400.57

booked. The forward cover deals are all backed by actual trade underlines and settlement of these contracts on maturity 888.12 7.26 - 895.38 895.38

are by actual delivery of the hedged currency for settling the underline hedged trade transaction.

- Lease Liabilities (undiscounted) 27.86 53.38 7.54 88.78 73.34

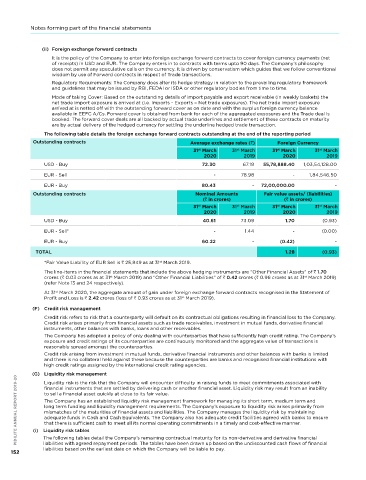

The following table details the foreign exchange forward contracts outstanding at the end of the reporting period Fixed interest rate instruments

Outstanding contracts Average exchange rates ( ) Foreign Currency - Trade/ Security Deposit received 123.86 - - 123.86 123.86

31 March 31 March 31 March 31 March Derviative liabilities towards foreign 0.42 - - 0.42 0.42

st

st

st

st

2020 2019 2020 2019 exchange forward contracts

Derviative liability towards put option to 34.83 - - 34.83 34.83

uSD - Buy 72.30 67.18 55,78,888.40 1,03,54,128.00 buy subsidiary shares

EuR - Sell - 78.98 - 1,84,546.50 Financial guarantee contracts 104.19 - - 104.19 -

As at 31 March 2019

st

EuR - Buy 80.43 - 72,00,000.00 - Non-interest bearing

Outstanding contracts Nominal Amounts Fair value assets/ (liabilities) - Trade Payables 449.15 - - 449.15 449.15

( in crores) ( in crores) - Other Financial Liabilities 330.00 3.81 - 333.81 333.81

31 March 31 March 31 March 31 March 779.15 3.81 - 782.96 782.96

st

st

st

st

2020 2019 2020 2019

Fixed interest rate instruments

uSD - Buy 40.61 73.09 1.70 (0.93) - Trade/ Security Deposit received 109.89 - - 109.89 109.89

EuR - Sell* - 1.44 - (0.00) Derviative liabilities towards foreign 0.96 - - 0.96 0.96

exchange forward contracts

EuR - Buy 60.22 - (0.42) - Derviative liability towards put option to - 42.20 - 42.20 42.20

buy subsidiary shares

TOTAL 1.28 (0.93) Financial guarantee contracts 88.64 - - 88.64 -

*Fair Value Liability of EuR Sell is 25,849 as at 31 March 2019. (H) Fair value measurements

st

This note provides information about how the Company determines fair values of various financial assets and financial liabilities.

The line-items in the financial statements that include the above hedging instruments are “Other Financial Assets” of 1.70

st

st

crores ( 0.03 crores as at 31 March 2019) and “Other Financial Liabilities” of 0.42 crores ( 0.96 crores as at 31 March 2019) (i) Fair value of the Company’s financial assets and financial liabilities that are measured at fair value on a recurring basis

(refer note 13 and 24 respectively). Some of the Company’s financial assets and financial liabilities are measured at fair value at the end of each reporting period.

The following table gives information about how the fair values of these financial assets and financial liabilities are determined

At 31 March 2020, the aggregate amount of gain under foreign exchange forward contracts recognised in the Statement of (in particular, the valuation technique(s) and inputs used).

st

Profit and Loss is 2.42 crores (loss of 0.93 crores as at 31 March 2019).

st

Financial Assets/ Financial Liabilities Fair value Fair value Valuation

(F) Credit risk management hierarchy technique(s)

As at As at and key

Credit risk refers to risk that a counterparty will default on its contractual obligations resulting in financial loss to the Company. 31 March 31 March input(s)

st

st

Credit risk arises primarily from financial assets such as trade receivables, investment in mutual funds, derivative financial 2020 2019

instruments, other balances with banks, loans and other receivables.

Various

The Company has adopted a policy of only dealing with counterparties that have sufficiently high credit rating. The Company’s 1 Investment in Mutual/Alternate listed funds - Various Level 1 Quoted bid

exposure and credit ratings of its counterparties are continuously monitored and the aggregate value of transactions is Investment Funds, Preference Shares, aggregate fair listed funds - prices in active

reasonably spread amongst the counterparties. Debentures and Bonds value of aggregate fair market

value of

Credit risk arising from investment in mutual funds, derivative financial instruments and other balances with banks is limited 1025.81 1,515.91

and there is no collateral held against these because the counterparties are banks and recognised financial institutions with crores crores

high credit ratings assigned by the international credit rating agencies.

2 Derivative assets and liabilities Assets - 1.70 Assets - 0.03 Level 2 Mark to market

crores

values acquired

crores; and

(G) Liquidity risk management towards foreign currency forward 0.42 crores 0.96 crores from banks, with

PIDILITE ANNUAL REPORT 2019-20 to sell a financial asset quickly at close to its fair value. 3 Derivative asset and liability towards Assets - 0.24 Assets - 7.61 Level 2 valuation model

contracts

Liabilities-

Liabilities -

Liquidity risk is the risk that the Company will encounter difficulty in raising funds to meet commitments associated with

whom the Com-

financial instruments that are settled by delivering cash or another financial asset. Liquidity risk may result from an inability

pany contracts.

Fair values of

The Company has an established liquidity risk management framework for managing its short term, medium term and

crores; and

call and put option to buy subsidiary

options using

crores; and

long term funding and liquidity management requirements. The Company’s exposure to liquidity risk arises primarily from

black scholes

Liabilities -

Liabilities-

shares

mismatches of the maturities of financial assets and liabilities. The Company manages the liquidity risk by maintaining

34.83 crores

42.2 crores

adequate funds in Cash and Cash Equivalents. The Company also has adequate credit facilities agreed with banks to ensure

based on

that there is sufficient cash to meet all its normal operating commitments in a timely and cost-effective manner.

Independent

Liquidity risk tables

(i)

The following tables detail the Company’s remaining contractual maturity for its non-derivative and derivative financial

liabilities with agreed repayment periods. The tables have been drawn up based on the undiscounted cash flows of financial

The carrying amount of financial assets and financial liabilities measured at amortised cost in the financial statements are

liabilities based on the earliest date on which the Company will be liable to pay. (ii) Financial instruments measured at amortised cost Valuer's report

a reasonable approximation of their fair values since the Company does not anticipate that the carrying amounts would be

152

significantly different from the values that would eventually be received or settled.