Page 151 - Annual Report 2019-20

P. 151

notes forming part of the financial statements notes forming part of the financial statements 149

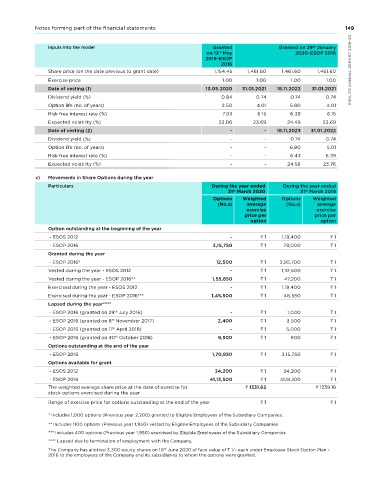

b) Fair value of share options granted Inputs into the model Granted Granted on 29 January

th

th

The fair value of the stock options has been estimated using Black-Scholes model which takes into account as of grant date on 13 May 2020-ESOP 2016

the exercise price and expected life of the option, the current market price of underlying stock and its expected volatility, 2019-ESOP

expected dividends on stock and the risk free interest rate for the expected term of the option. 2016

Share price (on the date previous to grant date) 1,154.45 1,461.60 1,461.60 1,461.60 PIDILITE ANNUAL REPORT 2019-20

Inputs into the model Granted on Granted on Granted on Granted on Granted on Granted on

27 July 29 January 29 July 29 July 9 november 8 november Exercise price 1.00 1.00 1.00 1.00

th

th

th

th

th

th

2015-ESOS 2016-ESOS 2016-ESOS 2016-ESOP 2016-ESOS 2017-ESOP Date of vesting (1) 13.05.2020 31.01.2021 18.11.2022 31.01.2021

2012 2012 2012 2016 2012 2016

Dividend yield (%) 0.84 0.74 0.74 0.74

Share price (on the date previous to 544.95 556.80 751.60 751.60 691.40 758.55

grant date) Option life (no. of years) 2.50 4.01 5.80 4.01

Exercise price 1.00 1.00 1.00 1.00 1.00 1.00 Risk free interest rate (%) 7.03 6.15 6.39 6.15

Date of vesting (1) 10.04.2017 29.01.2017 29.07.2017 29.07.2017 09.11.2017 08.11.2018 Expected volatility (%) 23.06 23.69 24.49 23.69

Dividend yield (%) 0.91 0.93 0.79 0.74 0.89 0.85 Date of vesting (2) - - 18.11.2023 31.01.2022

Dividend yield (%) - - 0.74 0.74

Option life (no. of years) 3.50 3.50 3.50 2.50 3.50 2.50

Option life (no. of years) - - 6.80 5.01

Risk free interest rate (%) 8.07 7.80 7.39 7.28 6.73 6.69

Risk free interest rate (%) - - 6.43 6.39

Expected volatility (%) 52.17 54.46 21.51 17.70 20.94 22.12

Expected volatility (%) - - 24.56 23.76

Date of vesting (2) 10.04.2018 29.01.2018 29.07.2018 29.07.2018 09.11.2018 08.11.2019

Dividend yield (%) 0.97 1.21 0.85 0.79 0.96 0.91 c) Movements in Share Options during the year

Option life (no. of years) 4.50 4.50 4.50 3.50 4.50 3.50 Particulars During the year ended During the year ended

st

st

Risk free interest rate (%) 8.07 7.80 7.56 7.39 6.93 6.64 31 March 2020 31 March 2019

options Weighted Options Weighted

Expected volatility (%) 52.17 54.46 24.25 21.51 23.94 24.01 (No.s) average (No.s) average

Date of vesting (3) - 29.01.2019 - - - - exercise exercise

price per price per

Dividend yield (%) - 1.27 - - - - option option

Option life (no. of years) - 5.50 - - - - Option outstanding at the beginning of the year

Risk free interest rate (%) - 7.80 - - - - - ESOS 2012 - 1 1,19,400 1

Expected volatility (%) - 54.46 - - - - - ESOP 2016 3,15,750 1 79,000 1

Granted during the year

rd

Inputs into the model Granted on Granted Granted on 23 January 2019-ESOP 2016 - ESOP 2016* 12,500 1 2,95,700 1

th

th

11 April on 30 Vested during the year - ESOS 2012 - 1 1,10,500 1

2018-ESOP October

2016 2018-ESOP Vested during the year - ESOP 2016** 1,55,850 1 47,200 1

2016 Exercised during the year - ESOS 2012 - 1 1,19,400 1

Share price (on the date previous to grant date) 1,000.15 961.55 1,152.80 1,152.80 1,152.80 Exercised during the year - ESOP 2016*** 1,45,500 1 48,550 1

Exercise price 1.00 1.00 1.00 1.00 1.00 Lapsed during the year****

Date of vesting (1) 11.04.2019 30.10.2019 23.01.2022 29.01.2021 01.02.2021 - ESOP 2016 (granted on 29 July 2016) - 1 1,000 1

th

Dividend yield (%) 0.62 2.54 0.84 0.84 0.84 - ESOP 2016 (granted on 8 november 2017) 2,400 1 3,500 1

th

Option life (no. of years) 2.50 2.50 6.00 5.02 5.02 - ESOP 2016 (granted on 11 April 2018) - 1 5,000 1

th

Risk free interest rate (%) 7.09 8.01 7.56 7.49 7.49 - ESOP 2016 (granted on 30 October 2018) 9,500 1 900 1

th

Expected volatility (%) 21.65 23.20 24.34 23.87 23.86 Options outstanding at the end of the year

Date of vesting (2) 11.04.2020 30.10.2020 23.01.2023 29.01.2022 01.02.2022 - ESOP 2016 1,70,850 1 3,15,750 1

Dividend yield (%) 0.66 3.62 0.84 0.84 0.84 Options available for grant

1

34,200

34,200

6.03

6.02

3.50

7.00

Option life (no. of years) 23.59 23.24 24.37 24.32 24.30 - ESOS 2012 41,13,500 1331.62 41,14,100 1239.18 1 1

3.50

PIDILITE ANNUAL REPORT 2019-20 Date of vesting (3) - 30.10.2021 23.01.2024 - - stock options exercised during the year 1 1

1

- ESOP 2016

Risk free interest rate (%)

7.28

7.56

8.02

7.58

7.56

The weighted average share price at the date of exercise for

Expected volatility (%)

-

-

-

Range of exercise price for options outstanding at the end of the year

0.84

Dividend yield (%)

4.82

* Includes 1,000 options (Previous year 2,200) granted to Eligible Employees of the Subsidiary Companies.

8.00

-

Option life (no. of years)

-

4.50

-

** Includes 1100 options (Previous year 1,950) vested by Eligible Employees of the Subsidiary Companies

-

7.65

-

-

8.15

Risk free interest rate (%)

**** Lapsed due to termination of employment with the Company.

The Company has allotted 3,300 equity shares on 10 June 2020 of face value of 1/- each under Employee Stock Option Plan -

th

148 Expected volatility (%) - 24.34 24.40 - - *** Includes 400 options (Previous year 1,950) exercised by Eligible Employees of the Subsidiary Companies

2016 to the employees of the Company and its subsidiaries to whom the options were granted.