Page 146 - Annual Report 2019-20

P. 146

Notes forming part of the financial statements Notes forming part of the financial statements 145

Valuations in respect of above have been carried out by independent actuary, as at the balance sheet date, based on the

following assumptions:

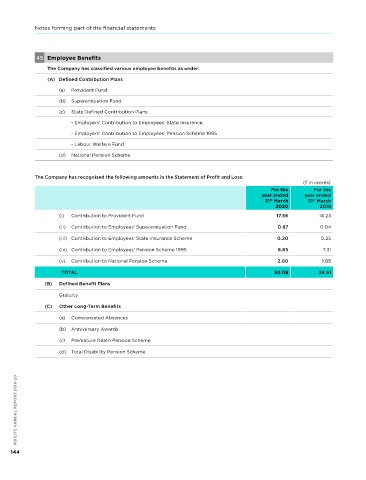

45 Employee Benefits Valuations as at

31 March 2020 31 March 2019

st

st

The Company has classified various employee benefits as under: PIDILITE ANNUAL REPORT 2019-20

(i) Discount Rate (per annum) 6.65% 7.40%

(A) Defined Contribution Plans (ii) Rate of increase in Compensation levels (per annum) 1 yr-4%, 1 2 yrs - 8.50%,

st

st

thereafter 6.50% thereafter 6.50%

(a) Provident Fund

(iii) Expected Rate of Return on Assets 6.65% 7.40%

(b) Superannuation Fund (iv) Attrition Rate upto 5 yrs - 13%, upto 5 yrs - 14%,

5 - 10 yrs - 5%, 5 - 10 yrs - 8%,

(c) State Defined Contribution Plans

Above 10 yrs - 5% Above 10 yrs - 5%

- Employers' Contribution to Employees' State Insurance (v) Retirement Age 60 years 60 years

- Employers' Contribution to Employees' Pension Scheme 1995 (vi) The expected rate of return on plan assets is determined after considering several applicable factors such as the

composition of the plan assets, investment/ strategy, market scenario, etc. In order to protect the capital and

- Labour Welfare Fund optimise returns within acceptable risk parameters, the plan assets are well diversified.

(vii) The discount rate is based on the prevailing market yields of Government of India securities as at the balance sheet

(d) national Pension Scheme date for the estimated term of the obligations.

(viii) The estimate of future salary increases considered, takes into account the inflation, seniority, promotion, increments

and other relevant factors.

The Company has recognised the following amounts in the Statement of Profit and Loss: Gratuity fund asset is managed by Life Insurance Corporation of India and the Company has funding ratio of about

( in crores) 94% (i.e. asset over liability ratio of 94%) in the current year, and hence, there is no material risk that the Company

For the For the would be unable to meet its Gratuity liability. Also as the fund is set up as a trust, the monies as a part of the trust

year ended year ended will not flow back into the Company until the last employee of the trust is paid.

31 March 31 March

st

st

2020 2019 Note on other risks:

(i) Contribution to Provident Fund 17.56 14.23 1 Investment Risk – The funds are invested by LIC and they provide returns basis the prevalent bond yields, LIC on

an annual basis requests for contributions to the fund, while the contribution requested may not be on the same

interest rate as the bond yields provided, basis the past experience it is low risk.

(ii) Contribution to Employees’ Superannuation Fund 0.87 0.84

2 Interest Risk – LIC does not provide market value of assets, rather maintains a running statement with interest rates

(iii) Contribution to Employees’ State Insurance Scheme 0.20 0.25 declared annually – The fall in interest rate is not therefore offset by increase in value of Bonds, hence may pose

a risk.

(iv) Contribution to Employees’ Pension Scheme 1995 8.65 7.31 3 Longevity Risk – Since the gratuity payment happens at the retirement age of 60, longevity impact is very low at this

age, hence this is a non-risk.

(v) Contribution to national Pension Scheme 2.80 1.88

4 Salary Risk – The liability is calculated taking into account the salary increase, basis past experience of the

TOTAL 30.08 24.51 Company’s actual salary increases with the assumptions used, they are in line, hence this risk is low risk.

( in crores)

(B) Defined Benefit Plans

st

31 March 2020 31 March 2019

st

Gratuity Gratuity Gratuity

Funded Funded

(C) Other Long-Term Benefits (i) Changes in Present value of Obligation

(a) Compensated Absences 1 Present value of defined benefit obligation at the beginning of the year 74.28 62.72

2 Current Service Cost 6.98 5.52

(b) Anniversary Awards

3 Interest Cost 4.97 4.64

(c) Premature Death Pension Scheme 4 Actuarial (Gains)/Loss

Actuarial (gains)/ losses arising from changes in demographic assumption (0.04) 0.40

(d) Total Disability Pension Scheme

Actuarial (gains)/ losses arising from changes in financial assumption 1.28 2.33

Actuarial (gains)/ losses arising from changes in experience adjustment 13.42 1.81

5 Past Service cost (13.32) - (3.14)

-

PIDILITE ANNUAL REPORT 2019-20 (ii) Changes in Fair value of Plan Assets 69.89 64.12

Benefits Paid

6

87.57

7

Present value of defined benefit obligation at the end of the year

74.28

1

Fair value of plan assets at the beginning of the year

2

Expected Return on Plan Assets

5.17

4.74

(0.21)

Actuarial Gain/(Loss)

0.17

3

4.00

4

(3.14)

5

Benefits Paid

(5.51)

85.74

Fair value of plan assets at the end of the year

6 Employer's Contributions 16.40 69.89

144