Page 149 - Annual Report 2019-20

P. 149

Notes forming part of the financial statements notes forming part of the financial statements 147

( in crores)

31 March 2020 31 March 2019 46 Employee Stock option Scheme

st

st

Gratuity Gratuity

Funded Funded a) Details of Employee Share Options PIDILITE ANNUAL REPORT 2019-20

th

(iii) Net Benefit (Asset)/ Liability In the Annual General Meeting of the Company held on 24 July 2012, the shareholders approved the issue of 50,76,486

equity shares under the Scheme titled “Employee Stock Option Scheme 2012” (ESOS 2012). The Board approved Employees

1 Defined benefit obligation 87.57 74.28 Stock Option Scheme covering 3,00,000 Stock options, in terms of the regulations of the Securities and Exchange Board

of India.

2 Fair value of plan assets 85.74 69.89

The ESOS 2012 allows the issue of options to Eligible employees of the Company. Each option comprises one underlying

3 Net Benefit (Asset)/ Liability (refer Note 26) 1.83 4.39 equity share. The exercise price of each option shall be 1/- per equity share. The options vest in the manner as specified in

(iv) Expenses recognised in the Statement of Profit and Loss ESOS 2012. Options may be exercised within 5 years from the date of vesting.

1 Current Service Cost 6.98 5.52 ESOP 2016 covering grant of 45,00,000 options (including 2,50,000 Options to be granted to Eligible Employees/

nd

Directors of the subsidiary Companies) was approved by the shareholders through Postal Ballot on 2 April 2016. Each

2 Interest cost on benefit obligation (net) (0.21) (0.11) option comprises one underlying equity share. The exercise price shall be 1/- per option or such other higher price as may

be fixed by the Board or Committee. Options to be granted under the Plan shall vest not earlier than one year but not later

3 Total Expenses recognised in the Statement of Profit and Loss 6.77 5.41

than a maximum of six years from the date of grant of such options. In the case of Eligible Employee who has not completed

(v) Remeasurement Effects Recognised in Other Comprehensive Income 3 years of employment as on date of the grant of Options then the Options which are due for vesting before completion of 3

for the year years as above, shall vest as on the completion of 3 years of employment in the Company by the Employee concerned or as

1 Actuarial (gains)/ losses arising from changes in demographic assumption (0.04) 0.40 may be approved by the nomination and Remuneration Committee. Vested Options will have to be exercised within 3 years

from the date of respective vesting.

2 Actuarial (gains)/ losses arising from changes in financial assumption 1.28 2.33

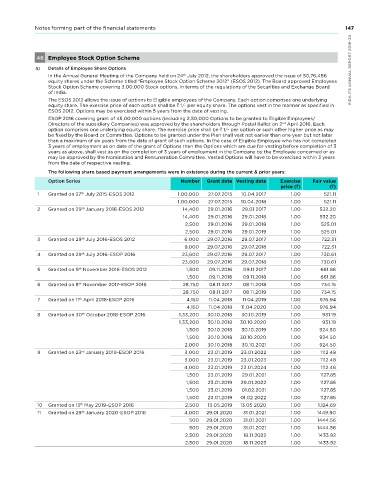

The following share based payment arrangements were in existence during the current & prior years:

3 Actuarial (gains)/ losses arising from changes in experience adjustment 13.42 1.81

Option Series Number Grant date Vesting date Exercise Fair value

4 Return on plan asset 0.21 (0.16) price ( ) ( )

5 Recognised in Other Comprehensive Income 14.88 4.37 1 Granted on 27 July 2015-ESOS 2012 1,00,000 27.07.2015 10.04.2017 1.00 521.11

th

(vi) Actual return on plan assets 4.96 4.91 1,00,000 27.07.2015 10.04.2018 1.00 521.11

th

2 Granted on 29 January 2016-ESOS 2012 14,400 29.01.2016 29.01.2017 1.00 532.20

For the For the 14,400 29.01.2016 29.01.2018 1.00 532.20

year ended year ended 2,500 29.01.2016 29.01.2018 1.00 525.01

31 March 2020 31 March 2019 2,500 29.01.2016 29.01.2019 1.00 525.01

st

st

(vii) Sensitivity Analysis 3 Granted on 29 July 2016-ESOS 2012 6,000 29.07.2016 29.07.2017 1.00 722.31

th

Defined Benefit Obligation 9,000 29.07.2016 29.07.2018 1.00 722.31

th

Discount Rate 4 Granted on 29 July 2016-ESOP 2016 23,600 29.07.2016 29.07.2017 1.00 730.61

a Discount Rate - 100 basis points 93.28 79.42 23,600 29.07.2016 29.07.2018 1.00 730.61

th

5 Granted on 9 november 2016-ESOS 2012 1,500 09.11.2016 09.11.2017 1.00 661.86

b Discount Rate + 100 basis points 82.55 69.78

1,500 09.11.2016 09.11.2018 1.00 661.86

Salary Increase Rate

6 Granted on 8 november 2017-ESOP 2016 28,750 08.11.2017 08.11.2018 1.00 734.15

th

a Rate - 100 basis points 82.47 69.72 28,750 08.11.2017 08.11.2019 1.00 734.15

b Rate + 100 basis points 93.27 79.39 7 Granted on 11 April 2018-ESOP 2016 4,150 11.04.2018 11.04.2019 1.00 976.94

th

Note on Sensitivity Analysis 4,150 11.04.2018 11.04.2020 1.00 976.94

th

1 Sensitivity analysis for each significant actuarial assumptions of the Company which are discount rate and salary 8 Granted on 30 October 2018-ESOP 2016 1,33,200 30.10.2018 30.10.2019 1.00 931.19

assumptions as of the end of the reporting period, showing how the defined benefit obligation would have been 1,33,200 30.10.2018 30.10.2020 1.00 931.19

affected by changes is called out in the table above.

2 The method used to calculate the liability in these scenarios is by keeping all the other parameters and the data 1,500 30.10.2018 30.10.2019 1.00 924.50

same as in the base liability calculation except for the parameters to be stressed. 1,500 30.10.2018 30.10.2020 1.00 924.50

2,000 30.10.2018 30.10.2021 1.00 924.50

3 There is no change in the method from the previous period and the points/ percentage by which the assumptions

rd

are stressed are same to that in the previous year. 9 Granted on 23 January 2019-ESOP 2016 3,000 23.01.2019 23.01.2022 1.00 1112.48

3,000 23.01.2019 23.01.2023 1.00 1112.48

For the For the

year ended

year ended 31 March 2019 4,000 23.01.2019 23.01.2024 1.00 1112.48

29.01.2021

23.01.2019

1,500

1.00

1127.85

31 March 2020

st

st

PIDILITE ANNUAL REPORT 2019-20 year 1 13.89 14.36 10 Granted on 13 May 2019-ESOP 2016 4,000 29.01.2020 01.02.2022 1.00 1,124.69

1127.85

1,500

29.01.2022

1.00

23.01.2019

(viii) Expected Future Cashflows

1127.85

01.02.2021

23.01.2019

1,500

1127.85

1.00

1,500

23.01.2019

year 2

8.35

6.08

13.05.2019

13.05.2020

2,500

1.00

th

8.81

7.45

year 3

31.01.2021

Granted on 29 January 2020-ESOP 2016

1449.90

11

1.00

th

7.91

year 4

8.02

1.00

29.01.2020

500

1444.56

31.01.2021

year 5

7.08

7.05

1.00

1444.56

500

29.01.2020

31.01.2021

31.89

1433.92

18.11.2023

2,500

29.01.2020

1.00

146 (ix) year 6 to 10 35.71 10.24 2,500 29.01.2020 18.11.2022 1.00 1433.92

11.09

Average Expected Future Working Life (yrs)