Page 204 - Annual Report 2019-20

P. 204

notes forming part of the consolidated financial statements notes forming part of the consolidated financial statements 203

( in crores)

As at As at 7 Investments accounted for using equity method

st

st

31 March 2020 31 March 2019

As at 31 March 2020 As at 31 March 2019

st

st

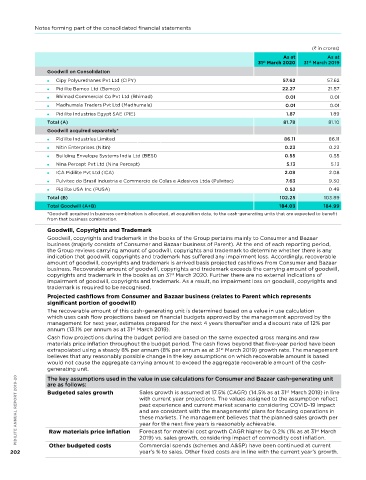

Goodwill on Consolidation Qty in crores Qty in crores PIDILITE ANNUAL REPORT 2019-20

Cipy Polyurethanes Pvt Ltd (CIPy) 57.62 57.62 Carrying amount determined using the Equity method of accounting

Pidilite Bamco Ltd (Bamco) 22.27 21.57 A] Investment in Equity Instruments (Quoted)

Bhimad Commercial Co Pvt Ltd (Bhimad) 0.01 0.01 Investment in Associates (fully paid up)

Madhumala Traders Pvt Ltd (Madhumala) 0.01 0.01 Equity Shares of 1 each of Vinyl Chemicals (India) Ltd 74,51,540 1.18 74,51,540 1.18

Pidilite Industries Egypt SAE (PIE) 1.87 1.89 Add: Share in accumulated Profits/ Reserves 24.12 23.25

Total [A] 25.30 24.43

Total (A) 81.78 81.10

B] Investment in Joint Venture (fully paid up) (Unquoted)

Goodwill acquired separately*

Equity Shares of AED 1000 each of Plus Call Technical 57 0.21 57 0.21

Pidilite Industries Limited 86.11 86.11 Services LLC

nitin Enterprises (nitin) 0.23 0.23 Add: Share in accumulated Profits/ Reserves 1.56 1.56

Building Envelope Systems India Ltd (BESI) 0.55 0.55 1.77 1.77

Less: Impairment in value of Investments* (1.77) (1.77)

nina Percept Pvt Ltd (nina Percept) 5.13 5.13

Total [B] - -

ICA Pidilite Pvt Ltd (ICA) 2.08 2.08

TOTAL [(A)+(B)] 25.30 24.43

Pulvitec do Brasil Industria e Commercio de Colas e Adesivos Ltda (Pulvitec) 7.63 9.30 st

*During the year, Group has recognised impairment amounting to Nil crores ( 1.77 crores for the year ended 31 March 2019) for

st

Pidilite uSA Inc (PuSA) 0.52 0.49 investment made in Joint Venture and Nil crores ( 4.36 crores for the year ended 31 March 2019) for the loan given to Joint

Venture (refer note 41).

Total (B) 102.25 103.89

Aggregate carrying value of quoted investments 25.30 24.43

Total Goodwill (A+B) 184.03 184.99

Aggregate market value of quoted investments 31.15 60.10

*Goodwill acquired in business combination is allocated, at acquisition date, to the cash-generating units that are expected to benefit

from that business combination. Aggregate carrying value of unquoted investments - -

Aggregate amount of Impairment in value of investments 1.77 1.77

Goodwill, Copyrights and Trademark

Goodwill, copyrights and trademark in the books of the Group pertains mainly to Consumer and Bazaar 8 Investments - Non-Current

business (majorly consists of Consumer and Bazaar business of Parent). At the end of each reporting period,

st

st

the Group reviews carrying amount of goodwill, copyrights and trademark to determine whether there is any As at 31 March 2020 As at 31 March 2019

indication that goodwill, copyrights and trademark has suffered any impairment loss. Accordingly, recoverable Qty in crores Qty in crores

amount of goodwill, copyrights and trademark is arrived basis projected cashflows from Consumer and Bazaar A] Investment in Equity Instruments (fully paid up) (at FVTPL)

business. Recoverable amount of goodwill, copyrights and trademark exceeds the carrying amount of goodwill, (Unquoted)

copyrights and trademark in the books as on 31 March 2020. Further there are no external indications of Equity Shares of 10 each of Pal Peugeot Ltd 1,21,300 0.12 1,21,300 0.12

st

impairment of goodwill, copyrights and trademark. As a result, no impairment loss on goodwill, copyrights and

trademark is required to be recognised. Less: Impairment in value of Investments (0.12) (0.12)

projected cashflows from Consumer and Bazaar business (relates to parent which represents Total [A] - -

significant portion of goodwill) B] Investment in Preference Shares (at FVTPL) (Quoted)

The recoverable amount of this cash-generating unit is determined based on a value in use calculation non-Cumulative Perpetual Preference Shares of Kotak Mahindra 3,00,00,000 15.20 3,00,00,000 15.00

Bank Ltd

which uses cash flow projections based on financial budgets approved by the management approved by the

management for next year, estimates prepared for the next 4 years thereafter and a discount rate of 12% per Total [B] 15.20 15.00

annum (13.1% per annum as at 31 March 2019). C] Investment in Debentures, Bonds & Market Instruments (at FVTPL) (Quoted)

st

Cash flow projections during the budget period are based on the same expected gross margins and raw units of Bharat Bond ETFs 2,50,000 25.55 - -

materials price inflation throughout the budget period. The cash flows beyond that five-year period have been Total [C] 25.55 -

extrapolated using a steady 8% per annum (8% per annum as at 31 March 2019) growth rate. The management D] Investment in Alternative Investment Fund (at FVTPL) (Unquoted)

st

believes that any reasonably possible change in the key assumptions on which recoverable amount is based units of Fireside Ventures Investment Fund II 50,000 4.13 - -

would not cause the aggregate carrying amount to exceed the aggregate recoverable amount of the cash-

generating unit. Total [D] 4.13 -

E] Investment in Promissory Note (at FVTPL) (Unquoted) 1 3.77 1 3.46

The key assumptions used in the value in use calculations for Consumer and Bazaar cash-generating unit

PIDILITE ANNUAL REPORT 2019-20 Budgeted sales growth Sales growth is assumed at 17.5% (CAGR) (14.5% as at 31 March 2019) in line F] Investments in Preference Shares (at FVTPL) (Unquoted) 1,47,80,200 49.00 - -

Convertible Promissory note of Clare Inc [refer note 56 (a)]

are as follows:

3.46

3.77

Total [E]

st

with current year projections. The values assigned to the assumption reflect

[refer Note 56 (b)]

past experience and current market scenario considering COVID-19 impact

Compulsory Convertible Cumulative Preference Shares of

17,52,734

and are consistent with the managements’ plans for focusing operations in

homevista Décor & Furnishings Pvt Ltd

these markets. The management believes that the planned sales growth per

71.48

-

-

Compulsory Convertible non-Cumulative Preference Shares of

year for the next five years is reasonably achievable.

Trendsutra Platform Services Pvt Ltd

Forecast for material cost growth CAGR higher by 0.2% (1% as at 31 March

Raw materials price inflation

st

2.00

Compulsory Convertible Cumulative Preference Shares of

Aapkapainter Solutions Pvt Ltd

Commercial spends (schemes and A&SP) have been continued at current

-

year’s % to sales. Other fixed costs are in line with the current year’s growth.

202 Other budgeted costs 2019) vs. sales growth, considering impact of commodity cost inflation. Total [F] 1,625 122.48 - -