Page 207 - Annual Report 2019-20

P. 207

notes forming part of the consolidated financial statements notes forming part of the consolidated financial statements 205

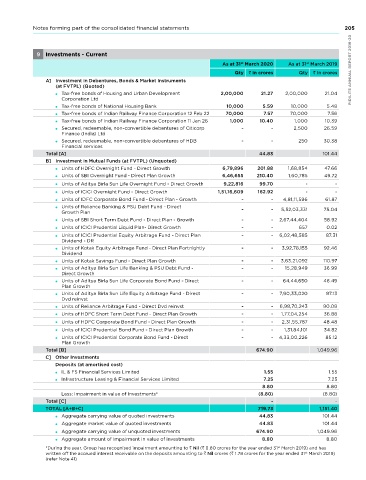

9 Investments - Current

As at 31 March 2020 As at 31 March 2019

st

st

st

st

Qty in crores Qty in crores As at 31 March 2020 As at 31 March 2019

G] Investment in Promissory Note (at amortised cost) (Unquoted) Qty in crores Qty in crores PIDILITE ANNUAL REPORT 2019-20

Convertible Promissory note of Optmed Inc** 1 5.65 1 5.20 A] Investment in Debentures, Bonds & Market Instruments

(at FVTPL) (Quoted)

Less : Impairment in value of Investments (1.41) (1.31) Tax-free bonds of housing and urban Development 2,00,000 21.27 2,00,000 21.04

Total [G] 4.24 3.89 Corporation Ltd

H] Investment in Mutual Funds (at FVTPL) (Unquoted) Tax-free bonds of national housing Bank 10,000 5.59 10,000 5.48

Tax-free bonds of Indian Railway Finance Corporation 12 Feb 22 70,000 7.57 70,000 7.56

units of Aditya Birla Sun Life FTP-Series PJ (1135 days) - Direct 1,00,00,000 11.81 1,00,00,000 10.82

Growth Tax-free bonds of Indian Railway Finance Corporation 11 Jan 26 1,000 10.40 1,000 10.39

units of Aditya Birla Sun Life FTP-Series PK (1132 days) - Direct 2,00,00,000 23.55 2,00,00,000 21.59 Secured, redeemable, non-convertible debentures of Citicorp - - 2,500 26.59

Growth Finance (India) Ltd

units of DSP BlackRock FMP S223-39M - Direct Growth 1,50,00,000 17.76 1,50,00,000 16.27 Secured, redeemable, non-convertible debentures of hDB - - 250 30.38

Financial services

units of DSP BlackRock FMP S224-39M - Direct Growth 1,50,00,000 17.67 1,50,00,000 16.21 Total [A] 44.83 101.44

units of hDFC FMP 1143D March 2018 (1) - Direct Growth - S39 1,00,00,000 11.81 1,00,00,000 10.82 B] Investment in Mutual Funds (at FVTPL) (Unquoted)

units of IDFC FTP Series 140 Direct Plan - Growth (1145 days) 1,50,00,000 17.73 1,50,00,000 16.25 units of hDFC Overnight Fund - Direct Growth 6,79,896 201.88 1,68,854 47.66

units of Kotak FMP Series 219 - Direct Growth 1,50,00,000 17.77 1,50,00,000 16.29 units of SBI Overnight Fund - Direct Plan Growth 6,46,655 210.40 1,60,785 49.72

units of Aditya Birla Sun Life Overnight Fund - Direct Growth 9,22,816 99.70 - -

units of ICICI FMP Series 83 1105 D Plan F - Direct Growth 50,00,000 5.91 50,00,000 5.42

units of ICICI Overnight Fund - Direct Growth 1,51,16,609 162.92 - -

units of Reliance FMP XXXVII Series 12 - Direct Growth 1,00,00,000 11.83 1,00,00,000 10.83

units of IDFC Corporate Bond Fund - Direct Plan - Growth - - 4,81,11,596 61.87

units of Kotak FMP Series 251 - 1265 days Direct Plan Growth 2,00,00,000 23.12 2,00,00,000 21.01

units of Reliance Banking & PSu Debt Fund - Direct - - 5,52,03,331 75.04

units of SBI FMP Series C33 1216 days - Direct Growth 2,00,00,000 22.69 2,00,00,000 20.66 Growth Plan

units of SBI Debt Fund Series C49 1178 days - Direct 2,00,00,000 22.06 2,00,00,000 20.08 units of SBI Short Term Debt Fund - Direct Plan - Growth - - 2,67,44,404 58.92

Plan Growth units of ICICI Prudential Liquid Plan- Direct Growth - - 657 0.02

units of hDFC FMP 1182D Jan 2019 (1) - Direct Growth 2,00,00,000 22.57 2,00,00,000 20.54 units of ICICI Prudential Equity Arbitrage Fund - Direct Plan - - 6,02,48,585 87.31

units of hDFC FMP 1126D Mar 2019 (1) - Direct Growth 2,00,00,000 22.21 2,00,00,000 20.20 Dividend - DR

units of Kotak Equity Arbitrage Fund - Direct Plan Fortnightly - - 3,92,78,155 92.46

units of IDFC FTP Series 149- Direct Plan Growth 1,50,00,000 17.26 1,50,00,000 16.17 Dividend

units of IDFC Money Manager Fund 9,191 0.04 - - units of Kotak Savings Fund - Direct Plan Growth - - 3,63,21,092 110.97

units of ICICI Prudential Short Term Fund - Growth - - 1,12,15,155 45.25 units of Aditya Birla Sun Life Banking & PSu Debt Fund - - - 15,28,949 36.99

Direct Growth

units of Axis Banking & PSu Debt fund - Direct Plan Growth - - 1,16,058 20.54

units of Aditya Birla Sun Life Corporate Bond Fund - Direct - - 64,44,650 46.49

units of IDFC Banking and PSu Debt Fund - Direct - - 1,23,89,578 20.10 Plan Growth

Plan Growth units of Aditya Birla Sun Life Equity Arbitrage Fund - Direct - - 7,90,33,020 87.13

units of SBI Banking & PSu Debt Fund - Direct Plan Growth - - 95,378 20.47 Dvd reinvst

Total [H] 265.79 349.52 units of Reliance Arbitrage Fund - Direct Dvd reinvst - - 6,98,70,243 90.08

units of hDFC Short Term Debt Fund - Direct Plan Growth - - 1,77,04,254 36.88

Total [A+B+C+D+E+F+G+H] 441.16 371.87

units of hDFC Corporate Bond Fund - Direct Plan Growth - - 2,31,55,787 48.48

Aggregate carrying value of quoted investments 40.75 15.00

units of ICICI Prudential Bond Fund - Direct Plan Growth - - 1,31,84,101 34.82

Aggregate market value of quoted investments 40.75 15.00

units of ICICI Prudential Corporate Bond Fund - Direct - - 4,33,00,226 85.12

Aggregate carrying value of unquoted investments 400.41 356.87 Plan Growth

Aggregate amount of Impairment in value of investments 1.53 1.43 Total [B] 674.90 1,049.96

C] Other Investments

**The Group invested in convertible promissory note of Optimed Inc., the conversion of which is subject to various covenants and an Deposits (at amortised cost)

option to convert at the sole discretion of the Group upon certain future event. Management has considered and valued this invest- IL & FS Financial Services Limited 1.55 1.55

ment as a ‘debt instrument’ and believes that the valuation of the option can be done only after the occurrence of the specific future Infrastructure Leasing & Financial Services Limited 8.80 8.80

PIDILITE ANNUAL REPORT 2019-20 TOTAL [A+B+C] 719.73 1,151.40

7.25

7.25

event. During the year, Group has recognised impairment amounting to Nil crores ( 1.31 crores for the year ended 31 March 2019)

st

(refer note 41) and has written off the accrued interest receivable on the promissory notes amounting to Nil crores ( 1.10 crores for

the year ended 31 March 2019).

st

(8.80)

Less: Impairment in value of Investments*

(8.80)

Total [C]

-

-

44.83

Aggregate carrying value of quoted investments

101.44

101.44

Aggregate market value of quoted investments

44.83

1,049.96

674.90

Aggregate carrying value of unquoted investments

Aggregate amount of Impairment in value of investments

8.80

*During the year, Group has recognised impairment amounting to Nil ( 8.80 crores for the year ended 31 March 2019) and has 8.80

st

204 written off the accrued interest receivable on the deposits amounting to Nil crores ( 1.78 crores for the year ended 31 March 2019)

st

(refer note 41)