Page 211 - Annual Report 2019-20

P. 211

Notes forming part of the consolidated financial statements Notes forming part of the consolidated financial statements 209

( in crores) ( in crores)

16 Bank Balances other than Cash and Cash Equivalents above 19 Current Tax Assets (net)

As at As at As at As at

31 March 31 March 31 March 31 March PIDILITE ANNUAL REPORT 2019-20

st

st

st

st

2020 2019 2020 2019

Balance with banks Advance Payment of Taxes (net of provisions) 1.93 2.62

In Escrow Account 0.14 0.04 TOTAL 1.93 2.62

Other Bank Balance

In Fixed Deposit Accounts with original maturity of more than 12 months (refer note a) - 0.29 20 Other Non-Current Assets

In Fixed Deposit Accounts with original maturity of more than 3 months but upto 7.62 60.13 As at As at

12 months (refer note a) 31 March 31 March

st

st

Earmarked Account 2020 2019

Dividend Payment Bank Account 3.26 1.85 Unsecured, Considered good

TOTAL 11.02 62.31 Capital Advances 47.50 19.93

Prepaid Expenses 0.27 41.53

a. Includes Fixed Deposit under lien 0.99 2.57

Balance with Government Authorities* 25.01 27.43

17 Inventories (at lower of cost and net realisable value) TOTAL 72.78 88.89

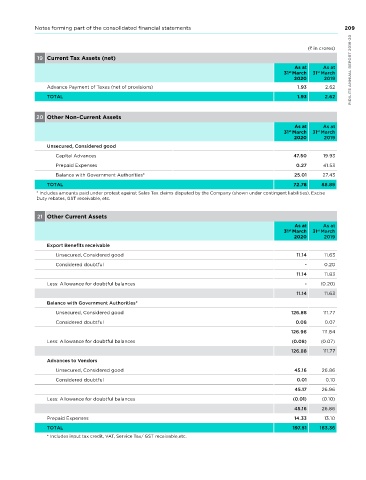

* Includes amounts paid under protest against Sales Tax claims disputed by the Company (shown under contingent liabilities), Excise

As at As at Duty rebates, GST receivable, etc.

31 March 31 March

st

st

2020 2019

Raw Material and Packing Material 420.44 404.72 21 Other Current Assets

Work-in-Progress 78.75 84.02 As at As at

st

st

31 March 31 March

Finished Goods 312.62 321.24 2020 2019

Stock-in-Trade (acquired for trading) 111.30 118.63 Export Benefits receivable

Stores and Spares 6.36 5.84 unsecured, Considered good 11.14 11.63

TOTAL 929.47 934.45 Considered doubtful - 0.20

Included above Goods-in-Transit 11.14 11.83

Raw Material and Packing Material 41.79 43.99 Less: Allowance for doubtful balances - (0.20)

Work-in-Progress 1.87 1.80 11.14 11.63

Finished Goods 41.15 43.90 Balance with Government Authorities*

Stock-in-Trade (acquired for trading) 8.69 6.28 unsecured, Considered good 126.88 111.77

TOTAL 93.50 95.97 Considered doubtful 0.08 0.07

a. The cost of inventories recognised as an expense during the year in respect of continuing operations was 3,402.50 126.96 111.84

crores ( 3,586.58 crores for the year ended 31 March 2019). Less: Allowance for doubtful balances (0.08) (0.07)

st

b. The cost of inventories recognised as an expense includes 0.37 crores in respect of write-downs of inventory to net

realisable value ( 0.27 crores for the year ended 31 March 2019). 126.88 111.77

st

c. The mode of valuation of inventories has been stated in note 2.14 Advances to Vendors

unsecured, Considered good 45.16 26.86

PIDILITE ANNUAL REPORT 2019-20 Advance Payment of Taxes (net of provisions) 31 March 31 March Less: Allowance for doubtful balances 197.51 163.36

18 Income Tax Assets (net) - Non-Current

Considered doubtful

0.10

0.01

As at

As at

45.17

26.96

st

st

(0.01)

(0.10)

2020

2019

109.53

102.06

26.86

45.16

TOTAL

13.10

102.06

Prepaid Expenses

109.53

14.33

TOTAL

208 * Includes input tax credit, VAT, Service Tax/ GST receivable,etc.