Page 216 - Annual Report 2019-20

P. 216

Notes forming part of the consolidated financial statements Notes forming part of the consolidated financial statements 215

( in crores) ( in crores)

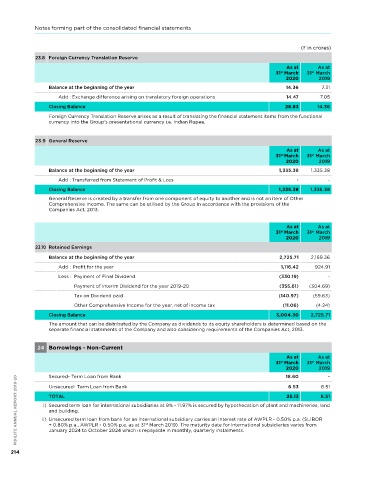

23.8 Foreign Currency Translation Reserve 25 Borrowings - Current

As at As at As at As at

31 March 31 March 31 March 31 March PIDILITE ANNUAL REPORT 2019-20

st

st

st

st

2020 2019 2020 2019

Balance at the beginning of the year 14.36 7.31 Secured - at amortised cost

Add : Exchange difference arising on translatory foreign operations 14.47 7.05 1) Loans repayable on demand from banks

i) Working Capital Demand Loan 39.63 27.44

Closing Balance 28.83 14.36

ii) Cash Credit - 4.42

Foreign Currency Translation Reserve arises as a result of translating the financial statement items from the functional

currency into the Group’s presentational currency i.e. Indian Rupee. iii) Bank Overdraft 50.34 18.93

2) Amount due on Factoring 7.32 10.43

Unsecured - at amortised cost

23.9 General Reserve

Loans repayable on demand from banks

As at As at

31 March 31 March i) Working Capital Demand Loan 11.18 9.49

st

st

2020 2019 ii) Bank Overdraft 35.52 31.83

Balance at the beginning of the year 1,335.38 1,335.38 TOTAL 143.99 102.54

Add : Transferred from Statement of Profit & Loss - - Secured

Closing Balance 1,335.38 1,335.38 1) i) Secured working capital demand loan for domestic subsidiaries carries interest rate of 8.5% p.a. (9.10% - 9.35% p.a.

as at 31 March 2019) and for international subsidiaries at 11.50% - 12.43%, LIBOR + 2.7% p.a.(4.44% p.a. as at

st

General Reserve is created by a transfer from one component of equity to another and is not an item of Other st

Comprehensive Income. The same can be utilised by the Group in accordance with the provisions of the 31 March 2019). The group working capital demand loan is secured by receivables, inventories, outstanding monies

Companies Act, 2013. and other assets.

st

ii) Secured cash credit facility interest rate for domestic subsidiaries is nIL (9.65% p.a. as at 31 March 2019) and

secured against hypothecation of inventory and receivables.

As at As at

31 March 31 March iii) Secured bank overdraft for domestic subsidiaries carries interest rate of 8.90% p.a. (9.60% to 9.80% p.a. as at

st

st

st

st

2020 2019 31 March 2019) and for international subsidiaries at AWPLR + 0.35% p.a. (AWPLR + 0.35% p.a. as at 31 March 2019).

It is secured by way of charge on receivables and inventory.

23.10 Retained Earnings

2) Secured amount due on factoring for domestic subsidiaries carries interest rate (including factoring cost) of 11.00% to

st

Balance at the beginning of the year 2,725.71 2,169.36 11.75% p.a. (11.00% to 11.75% p.a. as at 31 March 2019). It is secured by a charge against certain trade receivables.

Add : Profit for the year 1,116.42 924.91 Unsecured

Less : Payment of Final Dividend (330.19) - 1) i) unsecured working capital demand loan of international subsidiaries carries interest rate of 9.50% p.a. (9.94% p.a. as

at 31 March 2019).

st

Payment of Interim Dividend for the year 2019-20 (355.61) (304.69)

ii) unsecured bank overdraft for international subsidiaries carries interest rate of EIBOR + 1.55% p.a.(EIBOR+ 1.85% p.a.

Tax on Dividend paid (140.97) (59.63) as at 31 March 2019).

st

Other Comprehensive Income for the year, net of income tax (11.06) (4.24) ( in crores)

Closing Balance 3,004.30 2,725.71 26 Trade payables

The amount that can be distributed by the Company as dividends to its equity shareholders is determined based on the As at As at

st

st

separate financial statements of the Company and also considering requirements of the Companies Act, 2013. 31 March 31 March

2020 2019

Trade Payables

24 Borrowings - Non-Current

Total outstanding dues of micro enterprise and small enterprises 23.13 31.55

As at As at Total outstanding dues of creditors other than micro enterprise and small enterprises 597.88 549.09

31 March 31 March

st

st

2020 2019 27 Other Financial Liabilities - Non-Current 621.01 580.64

TOTAL

18.60

Secured- Term Loan from Bank

-

PIDILITE ANNUAL REPORT 2019-20 ii) unsecured term loan from bank for an international subsidiary carries an interest rate of AWPLR - 0.50% p.a. (SLIBOR BTA payable (refer note 45 a) 31 March 31 March

unsecured- Term Loan from Bank

6.53

8.51

As at

As at

TOTAL

8.51

25.13

st

st

2020

2019

i) Secured term loan for international subsidiaries at 9% - 11.97% is secured by hypothecation of plant and machineries, land

and building.

-

2.89

Payable on purchase of assets

-

3.11

+ 0.80% p.a., AWPLR - 0.50% p.a. as at 31 March 2019). The maturity date for international subsidiaries varies from

st

Gross obligation towards acquisition (refer note 45 b)

76.17

-

January 2024 to October 2024 which is repayable in monthly, quarterly instalments.

2.99

0.47

Employees related liabilities

0.82

214 Retention money payable 6.79 85.98

7.26

TOTAL