Page 224 - Annual Report 2019-20

P. 224

notes forming part of the consolidated financial statements Notes forming part of the consolidated financial statements 223

( in crores) ( in crores)

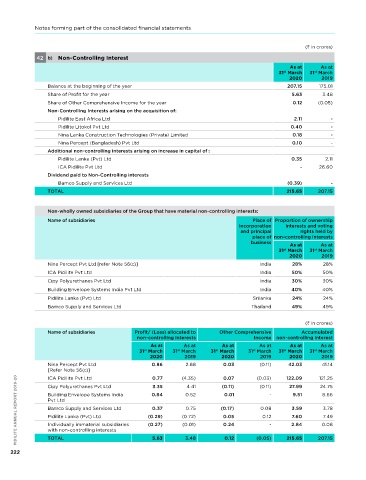

42 b) Non-Controlling Interest 43 Contingent Liabilities and Commitments

As at As at As at As at

31 March 31 March 31 March 31 March PIDILITE ANNUAL REPORT 2019-20

st

st

st

st

2020 2019 2020 2019

Balance at the beginning of the year 207.15 175.01 A) Contingent liabilities not provided for:

Share of Profit for the year 5.63 3.48

1. Claims against the Group not acknowledged as debts comprises of:

Share of Other Comprehensive Income for the year 0.12 (0.05)

a) Income Tax demand against the Group not provided for and relating to issues of deduction 59.96 31.37

Non-Controlling Interests arising on the acquisition of: and allowances in respect of which the Group is in appeal

Pidilite East Africa Ltd 2.11 - b) Excise Duty and Service Tax claims disputed by the Group relating to issues of 51.12 31.13

Pidilite Litokol Pvt Ltd 0.40 - classifications

c) Sales Tax (VAT, CST, Entry Tax and GST) claims disputed by the Group relating to issues of 167.08 182.14

nina Lanka Construction Technologies (Private) Limited 0.18 -

declaration forms and classifications

nina Percept (Bangladesh) Pvt Ltd 0.10 - d) Other Matters (relating to disputed Electricity Duty, Gram Panchayat Tax, open access 6.64 5.49

Additional non-controlling interests arising on increase in capital of : charges, etc.)

Pidilite Lanka (Pvt) Ltd 0.35 2.11 2. Guarantees given by Banks in favour of Government and others * 57.60 62.72

ICA Pidilite Pvt Ltd - 26.60

* Guarantees given are for business purpose.

Dividend paid to Non-Controlling interests

B) Commitments:

Bamco Supply and Services Ltd (0.39) -

TOTAL 215.65 207.15 a) Estimated amount of contracts, net of advances, remaining to be executed on Property, 206.10 71.06

Plant and Equipment, investments and not provided for

b) For other commitments, refer note 50(E)(ii) Financial instruments, 45 Business

Non-wholly owned subsidiaries of the Group that have material non-controlling interests: Combinations, 54 Lease and note 56(b)(iii) & note 57 for committed investment in

other entities

Name of subsidiaries Place of Proportion of ownership C) The Supreme Court in a judgement has held that provident fund contributions are payable on basic wage, dearness

incorporation interests and voting allowances and all other monthly allowances, which are universally, necessarily and ordinarily paid to all the employees

and principal rights held by in the establishment across the board. There are numerous interpretative issues relating to the judgement. As such,

place of non-controlling interests the Company has, based on legal advice and as a matter of caution, made provision for an estimated amount on a

business

As at As at prospective basis.

st

st

31 March 31 March ( in crores)

2020 2019

nina Percept Pvt Ltd [refer note 56(c)] India 28% 28% 44 Research & Development Expenditure

ICA Pidilite Pvt Ltd India 50% 50% For the For the

Cipy Polyurethanes Pvt Ltd India 30% 30% year ended year ended

st

st

31 March 31 March

Building Envelope Systems India Pvt Ltd India 40% 40% 2020 2019

Pidilite Lanka (Pvt) Ltd Srilanka 24% 24% Capital expenditure included in Property, Plant and Equipment 2.52 1.27

Bamco Supply and Services Ltd Thailand 49% 49%

Revenue expenditure charged to Statement of Profit and Loss 70.20 64.89

TOTAL 72.72 66.16

( in crores)

Name of subsidiaries Profit/ (Loss) allocated to Other Comprehensive Accumulated

non-controlling interests Income non-controlling interest 45 (a) During the financial year 2015-16, pursuant to a Business Transfer Agreement (BTA) entered into by the Company

As at As at As at As at As at As at with nina Concrete Systems Private Limited (nCSPL), the Company acquired the waterproofing Business (the

31 March 31 March 31 March 31 March 31 March 31 March “Business”), including all its assumed assets and assumed liabilities, of nCSPL, a private limited company based in

st

st

st

st

st

st

2020 2019 2020 2019 2020 2019 India (the “Seller”), as a going concern and on a slump sale basis for a lump-sum consideration, with effect from

th

17 April 2015.

nina Percept Pvt Ltd 0.86 2.88 0.03 (0.11) 42.03 41.14 The terms and conditions of the BTA included a total purchase consideration of 82.02 crores, out of which 78.90

[Refer note 56(c)] 0.77 (4.35) (0.11) (0.03) 122.09 121.25 crores was paid by the Company to the Seller as of 31 March 2020. A balance amount of 3.12 crores (refer note 28)

st

PIDILITE ANNUAL REPORT 2019-20 Building Envelope Systems India (0.29) (0.72) (0.17) 0.08 3.59 0.08 (b) During the financial year 2017-18, 70% shareholding in CIPy Polyurathanes Pvt Ltd (CIPy) was acquired by entering

ICA Pidilite Pvt Ltd

including holdback Amount will be payable by the Company to the Seller by 31 October 2020 (The original terms of

0.07

st

BTA agreement is extended till 15 April 2020) and the settlement of which is to be completed by 31 October 2020,

th

st

24.75

3.35

4.41

Cipy Polyurethanes Pvt Ltd

27.99

(0.11)

post verification of books of account.

-

0.52

9.51

0.01

0.84

8.66

An amount of net Working Capital, i.e. Receivables, Inventories, Retention Monies receivables, etc which would not

Pvt Ltd

have been fully realised by 15 April 2020, the settlement of which is to be completed by 31 October 2020, post

th

st

verification of books of account), shall be deducted by the Company from the holdback amount payable to seller or

3.78

0.75

Bamco Supply and Services Ltd

0.37

will be recoverable from the seller.

0.05

7.60

7.49

0.12

Pidilite Lanka (Pvt) Ltd

2.84

0.24

(0.27)

-

Individually immaterial subsidiaries

(0.01)

into a share purchase agreement for cash consideration of 96.40 crores.

TOTAL

balance 30% of equity share capital of CIPy on or after expiry of 3 years from acquisition date i.e. on or after

th

8 February 2021. Accordingly, a gross liability towards acquisition (refer note 28) has been recognised in this

with non-controlling interests 5.63 3.48 0.12 (0.05) 215.65 207.15 Pursuant to share purchase agreement, the Company has an option to purchase and the seller has an option to sell

222 financial statement based on a valuation report obtained from an independent valuer.