Page 243 - Annual Report 2019-20

P. 243

notes forming part of the consolidated financial statements notes forming part of the consolidated financial statements 241

( in crores)

2. Income Taxes relating to Continuing Operations 54 Lease

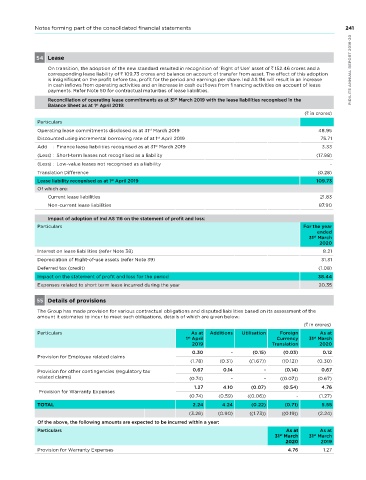

a Income Tax recognised in Profit or Loss On transition, the adoption of the new standard resulted in recognition of ‘Right of use’ asset of 152.46 crores and a PIDILITE ANNUAL REPORT 2019-20

corresponding lease liability of 109.73 crores and balance on account of transfer from asset. The effect of this adoption

Particulars As at As at is insignificant on the profit before tax, profit for the period and earnings per share. Ind AS 116 will result in an increase

31 March 31 March in cash inflows from operating activities and an increase in cash outflows from financing activities on account of lease

st

st

2020 2019 payments. Refer note 50 for contractual maturities of lease liabilities.

Current Tax Reconciliation of operating lease commitments as at 31 March 2019 with the lease liabilities recognised in the

st

Balance Sheet as at 1 April 2019:

st

In respect of the current year 384.00 459.45

( in crores)

In respect of prior years (0.01) (52.87) Particulars

TOTAL 383.99 406.58 Operating lease commitments disclosed as at 31 March 2019 48.95

st

Discounted using incremental borrowing rate of at 1 April 2019 75.71

st

Deferred Tax

Add : Finance lease liabilities recognised as at 31 March 2019 3.33

st

In respect of the current year (36.27) 6.65

(Less) : Short-term leases not recognised as a liability (17.98)

Total income tax expense recognised in the current year relating to continuing operations 347.72 413.23 (Less) : Low-value leases not recognised as a liability -

Translation Difference (0.28)

st

b The Income Tax expense for the year can be reconciled to the accounting profit as follows: Lease liability recognised as at 1 April 2019 109.73

Of which are:

As at As at

31 March 31 March Current lease liabilities 21.83

st

st

2020 2019 non-current lease liabilities 87.90

Profit before tax from continuing operations (after exceptional items) 1,466.74 1,338.02

Impact of adoption of Ind AS 116 on the statement of profit and loss:

Income Tax Rate (%) 25.17% 34.94%

Particulars For the year

Income Tax expense 369.15 467.56 ended

st

31 March

Effect of income that is exempt from taxation (5.03) (5.84) 2020

Interest on lease liabilities (refer note 38) 8.21

Effect of expenses that are not deductible in determining taxable profit and deductions 22.55 5.98

Depreciation of Right-of-use assets (refer note 39) 31.31

Effect of concessions (research and development and backward area deductions) (3.46) (16.76)

Deferred tax (credit) (1.08)

Effect of lower rate of tax (48.21) (17.71) Impact on the statement of profit and loss for the period 38.44

Effect of previously unrecognised and unused tax losses and deductible temporary - 0.25 Expenses related to short term lease incurred during the year 20.35

differences now recognised as deferred tax assets

Effect of previously unrecognised and unused tax losses and deductible temporary - - 55 Details of provisions

differences now recognised as deferred tax liabilities

The Group has made provision for various contractual obligations and disputed liabilities based on its assessment of the

Effect of the Company being taxed at lower tax rate (minimum alternate tax) as the (0.17) (0.03) amount it estimates to incur to meet such obligations, details of which are given below:

profits under tax laws are lower than the book profits

( in crores)

Effect of subsidiary companies taxed at a different rate than the holding company 5.83 31.15

Particulars As at Additions Utilisation Foreign As at

st

st

Others 7.07 1.50 1 April Currency 31 March

2019 Translation 2020

TOTAL 347.73 466.10 0.30 - (0.15) (0.03) 0.12

Provision for Employee related claims

Adjustments recognised in the current year in relation to the current tax of prior years (0.01) (52.87) (1.78) (0.31) ((1.67)) ((0.12)) (0.30)

-

0.67

(0.14)

0.67

Income tax expense recognised in profit or loss (relating to continuing operations) 347.72 413.23 Provision for other contingencies (regulatory tax (0.74) 0.14 (0.07) ((0.07)) (0.67)

related claims)

PIDILITE ANNUAL REPORT 2019-20 c. Income Tax recognised in Other Comprehensive Income 31 March 31 March Provision for Warranty Expenses (3.26) (0.90) ((0.06)) ((0.19)) (2.24)

-

-

(0.54)

4.76

1.27

4.10

(1.27)

(0.59)

(0.74)

-

As at

As at

2.24

TOTAL

(0.71)

(0.22)

5.55

4.24

st

st

2020

2019

((1.73))

Of the above, the following amounts are expected to be incurred within a year:

Tax arising on income and expenses recognised in Other Comprehensive Income:

As at

As at

Particulars

Re-measurement of Defined Benefit Obligation

st

st

2019

2020

3.58

1.83

1.27

4.76

240 Total Income Tax recognised in Other Comprehensive Income 3.58 1.83 Provision for Warranty Expenses 31 March 31 March