Page 238 - Annual Report 2019-20

P. 238

Notes forming part of the consolidated financial statements Notes forming part of the consolidated financial statements 237

( in crores)

st

st

Note on other risks: 31 March 2020 31 March 2019

Gratuity Gratuity Gratuity Gratuity

1 Investment Risk - The funds are invested by LIC and they provide returns basis the prevalent bond yields, LIC on an Funded Unfunded Funded Unfunded

annual basis requests for contributions to the fund, while the contribution requested may not be on the same interest PIDILITE ANNUAL REPORT 2019-20

rate as the bond yields provided, basis the past experience it is low risk. (iv) Expenses recognised in the Statement of Profit and Loss

2 Interest Risk – LIC does not provide market value of assets, rather maintains a running statement with interest rates 1 Current Service Cost 7.65 0.54 5.93 0.39

declared annually – The fall in interest rate is not therefore offset by increase in value of Bonds, hence may pose a risk. 2 Past Service Cost - - - -

3 Longevity Risk – Since the gratuity payment happens at the retirement age of 58-60, longevity impact is very low at 3 Interest cost on benefit obligation (net) (0.17) 0.23 (0.09) 0.16

this age, hence this is a non-risk.

4 Total Expenses recognised in the Statement of 7.48 0.77 5.84 0.55

4 Salary Risk - The liability is calculated taking into account the salary increases, basis past experience of the Group’s Profit and Loss

actual salary increases with the assumptions used, they are in line, hence this risk is low risk.

( in crores)

(v) Remeasurement Effects recognised in Other Comprehensive Income for the year

st

st

31 March 2020 31 March 2019

1 Actuarial (Gains)/ Loss

Gratuity Gratuity Gratuity Gratuity Actuarial (Gains)/ Loss arising from changes in 0.16 (0.04) 0.45 -

Funded Unfunded Funded Unfunded demographic assumption

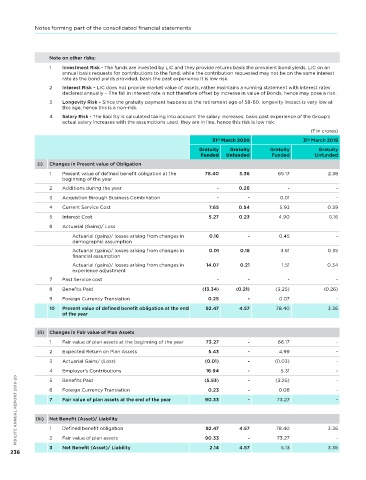

(i) Changes in Present value of Obligation Actuarial (Gains)/ Loss arising from changes in 0.01 0.18 3.61 0.35

financial assumption

1 Present value of defined benefit obligation at the 78.40 3.36 65.17 2.38

beginning of the year Actuarial (Gains)/ Loss arising from changes in 14.07 0.21 1.51 0.34

experience adjustment

2 Additions during the year - 0.26 - -

Return on plan asset 0.04 - 0.03 -

3 Acquistion through Business Combination - - 0.01 -

2 Recognised in Other Comprehensive Income 14.28 0.35 5.60 0.69

4 Current Service Cost 7.65 0.54 5.93 0.39

5 Interest Cost 5.27 0.23 4.90 0.16 (vi) Actual return on plan assets 5.26 - 4.92 -

6 Actuarial (Gains)/ Loss

Actuarial (gains)/ losses arising from changes in 0.16 - 0.45 - (vii) Sensitivity Analysis

demographic assumption

Defined Benefit Obligation

Actuarial (gains)/ losses arising from changes in 0.01 0.18 3.61 0.35 Discount Rate

financial assumption

a Discount Rate - 100 basis points 98.66 4.86 83.88 3.61

Actuarial (gains)/ losses arising from changes in 14.07 0.21 1.51 0.34

experience adjustment b Discount Rate + 100 basis points 87.06 4.30 73.61 3.19

7 Past Service cost - - - - Salary Increase Rate

8 Benefits Paid (13.34) (0.21) (3.25) (0.26) a Rate - 100 basis points 86.98 4.30 73.56 3.19

9 Foreign Currency Translation 0.25 - 0.07 - b Rate + 100 basis points 98.64 4.85 83.85 3.60

Note on Sensitivity Analysis

10 Present value of defined benefit obligation at the end 92.47 4.57 78.40 3.36

of the year 1 Sensitivity analysis for each significant actuarial assumptions of the Company which are discount rate and salary

assumptions as of the end of the reporting period, showing how the defined benefit obligation would have been

affected by changes is called out in the table above.

(ii) Changes in Fair value of Plan Assets 2 The method used to calculate the liability in these scenarios is by keeping all the other parameters and the data same

as in the base liability calculation except for the parameters to be stressed.

1 Fair value of plan assets at the beginning of the year 73.27 - 66.17 -

3 There is no change in the method from the previous period and the points/ percentage by which the assumptions are

2 Expected Return on Plan Assets 5.43 - 4.99 - stressed are same to that in the previous year.

3 Actuarial Gains/ (Loss) (0.01) - (0.03) - (viii) Expected Future Cashflows

5.31

4 Employer's Contributions (5.53) - (3.25) - year 1 14.61 0.57 14.56 0.46

0.73

16.94

PIDILITE ANNUAL REPORT 2019-20 (iii) 7 Net Benefit (Asset)/ Liability 90.33 4.57 78.40 3.36 year 4 37.76 0.49 33.44 0.43

8.52

0.50

year 2

6.80

-

5

Benefits Paid

-

year 3

7.65

9.07

0.61

0.38

Foreign Currency Translation

-

-

0.08

0.23

6

8.11

8.21

-

-

73.27

Fair value of plan assets at the end of the year

0.45

0.34

7.33

year 5

7.24

1.36

year 6 to 10

1.79

Defined benefit obligation

1

92.47

-

-

2.14

Net Benefit (Asset)/ Liability

5.13

3 2 Fair value of plan assets 90.33 4.57 73.27 3.36 (ix) Average Expected Future Working Life (yrs) 14.76 6.06 13.65 8.49

236