Page 237 - Annual Report 2019-20

P. 237

notes forming part of the consolidated financial statements notes forming part of the consolidated financial statements 235

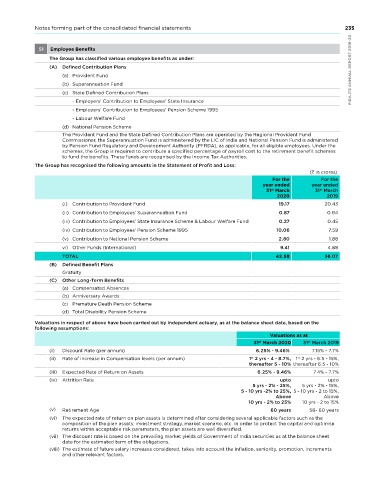

(H) Fair value measurements 51 Employee Benefits

This note provides information about how the Group determines fair values of various financial assets and financial liabilities. The Group has classified various employee benefits as under:

(i) Fair value of the Group’s financial assets and financial liabilities that are measured at fair value on a recurring basis (A) Defined Contribution Plans PIDILITE ANNUAL REPORT 2019-20

Some of the Group’s financial assets and financial liabilities are measured at fair value at the end of each reporting (a) Provident Fund

period. The following table gives information about how the fair values of these financial assets and financial liabilities are (b) Superannuation Fund

determined (in particular, the valuation technique(s) and inputs used).

(c) State Defined Contribution Plans

Financial Assets/ Financial Liabilities Fair value Fair value Valuation - Employers' Contribution to Employees' State Insurance

hierarchy Technique(s)

As at As at and key input(s) - Employers' Contribution to Employees' Pension Scheme 1995

st

st

31 March 31 March - Labour Welfare Fund

2020 2019

(d) national Pension Scheme

1 Investment in Mutual/Alternate Various listed Various listed Level 1 Quoted bid

Investment Funds, Preference funds - funds - prices in active The Provident Fund and the State Defined Contribution Plans are operated by the Regional Provident Fund

Commissioner, the Superannuation Fund is administered by the LIC of India and national Pension Fund is administered

Shares, Debentures and Bonds aggregate fair aggregate fair market by Pension Fund Regulatory and Development Authority (PFRDA), as applicable, for all eligible employees. under the

value of value of

1,034.49 1,515.92 schemes, the Group is required to contribute a specified percentage of payroll cost to the retirement benefit schemes

crores crores to fund the benefits. These funds are recognised by the Income Tax Authorities.

2 Derivative assets & liabilities Assets - 1.81 Assets - 0.03 Level 2 Mark to market The Group has recognised the following amounts in the Statement of Profit and Loss:

towards foreign currency forward crores; and crores; and values acquired ( in crores)

contracts liabilities - liabilities - from banks, with For the For the

0.42 crores 1.27 crores whom the Group year ended year ended

contracts. 31 March 31 March

st

st

3 Gross obligation towards Liabilities - Liabilities - Level 2 Fair values 2020 2019

acquisition 81.23 crores 76.17 crores of options using (i) Contribution to Provident Fund 19.17 20.43

black scholes

valuation model (ii) Contribution to Employees' Superannuation Fund 0.87 0.84

based on (iii) Contribution to Employees' State Insurance Scheme & Labour Welfare Fund 0.27 0.45

Independent

valuer’s report (iv) Contribution to Employees' Pension Scheme 1995 10.06 7.59

4 Investment in Promissory notes Aggregate fair value - Level 3 Fair value (v) Contribution to national Pension Scheme 2.80 1.88

of 122.48 crores is derived vi) Other Funds (International) 9.41 4.88

considering

recent financial TOTAL 42.58 36.07

rounds of

investment (B) Defined Benefit Plans

Gratuity

5 Investment in Promissory notes Aggregate fair Aggregate fair Level 3 Fair value

value of 3.77 value of is derived (C) Other Long-Term Benefits

crores 3.46 crores considering (a) Compensated Absences

recent financial

rounds of (b) Anniversary Awards

investment (c) Premature Death Pension Scheme

(d) Total Disability Pension Scheme

(ii) Financial instruments measured at amortised cost

Valuations in respect of above have been carried out by independent actuary, as at the balance sheet date, based on the

The carrying amount of financial assets and financial liabilities measured at amortised cost in the financial statements are following assumptions:

a reasonable approximation of their fair values since the Group does not anticipate that the carrying amounts would be Valuations as at

significantly different from the values that would eventually be received or settled.

31 March 2020 31 March 2019

st

st

(i) Discount Rate (per annum) 6.25% - 9.46% 7.15% - 7.7%

(ii) Rate of increase in Compensation levels (per annum) 1 2 yrs - 4 - 8.7%, 1 2 yrs - 6.5 - 15%,

st

st

thereafter 5 - 10% thereafter 6.5 - 10%

7.4% - 7.7%

(iii) Expected Rate of Return on Assets 5 - 10 yrs -2% to 25%, 5 - 10 yrs - 2 to 15%,

6.25% - 9.46%

PIDILITE ANNUAL REPORT 2019-20 (v) Retirement Age 10 yrs - 2% to 25% 10 yrs - 2 to 15%

(iv)

upto

upto

Attrition Rate

5 yrs - 2% - 25%,

5 yrs - 2% - 15%,

Above

Above

58- 60 years

60 years

The expected rate of return on plan assets is determined after considering several applicable factors such as the

(vi)

composition of the plan assets, investment strategy, market scenario, etc. In order to protect the capital and optimise

returns within acceptable risk parameters, the plan assets are well diversified.

(vii) The discount rate is based on the prevailing market yields of Government of India securities as at the balance sheet

date for the estimated term of the obligations.

(viii) The estimate of future salary increases considered, takes into account the inflation, seniority, promotion, increments

234 and other relevant factors.