Page 233 - Annual Report 2019-20

P. 233

notes forming part of the consolidated financial statements Notes forming part of the consolidated financial statements 231

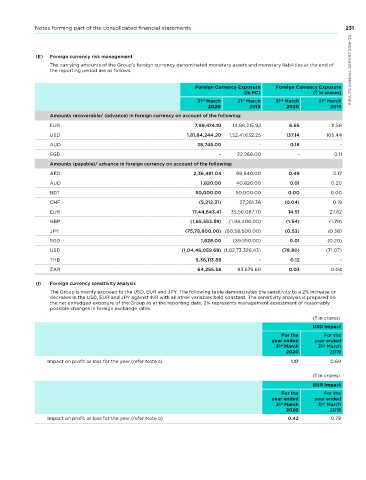

50 Financial Instruments (E) Foreign currency risk management

The carrying amounts of the Group’s foreign currency denominated monetary assets and monetary liabilities at the end of

(A) Capital Management

the reporting period are as follows. PIDILITE ANNUAL REPORT 2019-20

The Group manages its capital to ensure that the Group will be able to continue as going concern while maximising the return

to stakeholders through the optimum utilisation of the equity balance. The capital structure of the Group consists of equity

and borrowings of the Group. Foreign Currency Exposure Foreign Currency Exposure

(in FC) ( in crores)

(B) Categories of Financial Instruments 31 March 31 March 31 March 31 March

st

st

st

st

( in crores)

2020 2019 2020 2019

As at As at

st

31 March 31 March Amounts recoverable/ (advance) in foreign currency on account of the following:

st

2020 2019 EuR 7,99,474.10 14,88,215.92 6.65 11.56

Financial Assets uSD 1,81,84,244.20 1,52,41,632.25 137.14 105.44

Measured at fair value through profit or loss (FVTPL) AuD 38,745.00 - 0.18 -

Investments in Mutual funds, Preference Shares, Debentures and Bonds 1,152.88 1,515.92 SGD - 22,268.00 - 0.11

Derivative assets towards foreign exchange forward contracts 1.81 0.03 Amounts (payable)/ advance in foreign currency on account of the following:

Investments in Promissory notes 3.77 3.46 AED 2,36,491.04 88,540.00 0.49 0.17

Measured at amortised cost AuD 1,820.00 40,820.00 0.01 0.20

BDT 50,000.00 50,000.00 0.00 0.00

Investments in Deposits & Promissory notes 4.24 3.89

ChF (5,212.31) 27,261.36 (0.04) 0.19

Trade Receivables 1,088.50 1,056.01

EuR 17,44,843.41 35,56,087.70 14.51 27.62

Cash and Cash Equivalents 692.23 128.12

GBP (1,65,553.39) (1,98,406.00) (1.54) (1.79)

Other Bank balances 11.02 62.31

JPy (75,78,800.00) (60,58,500.00) (0.53) (0.38)

Loans 21.47 15.18

SGD 1,628.00 (39,550.00) 0.01 (0.20)

Other Financial Assets 144.22 113.32 uSD (1,04,46,059.69) (1,02,73,326.43) (78.80) (71.07)

Total Financial Assets 3,120.14 2,898.24 ThB 5,36,113.88 - 0.12 -

Financial Liabilities ZAR 64,255.58 83,679.60 0.03 0.04

Measured at fair value through profit or loss (FVTPL)

(i) Foreign currency sensitivity analysis

Derivative liabilities towards foreign exchange forward contracts 0.42 1.27 The Group is mainly exposed to the uSD, EuR and JPy. The following table demonstrates the sensitivity to a 2% increase or

decrease in the uSD, EuR and JPy against InR with all other variables held constant. The sensitivity analysis is prepared on

Measured at amortised cost (including trade payables) the net unhedged exposure of the Group as at the reporting date. 2% represents management assessment of reasonably

Borrowings 176.22 112.75 possible changes in foreign exchange rates.

( in crores)

Trade Payables 621.01 580.64

UsD impact

Lease Liabilities 111.47 -

For the For the

Gross obligation towards acquisition 81.23 76.17 year ended year ended

31 March 31 March

st

st

Other Financial Liabilities 587.25 504.07 2020 2019

Total Financial Liabilities 1,577.60 1,274.90 Impact on profit or loss for the year (refer note a) 1.17 0.69

(C) Financial risk management objectives ( in crores)

PIDILITE ANNUAL REPORT 2019-20 (D) Market risk Impact on profit or loss for the year (refer note b) year ended year ended

The Group’s Treasury functions provide services to the business, co-ordinates access to domestic and international financial

EUR impact

markets, monitors and manages the financial risks relating to the operations of the Group through internal risk reports which

For the

For the

analyse exposures by degree and magnitude of risks. These risks include market risk, credit risk and liquidity risk. The Group

undertakes transactions denominated in foreign currencies; consequently, exposures to exchange rate fluctuations arise.

st

31 March

st

31 March

Exchange rate exposures are managed within approved policy parameters utilising foreign exchange forward contracts.

2019

2020

Compliance with policies and exposure limits is a part of Internal Financial Controls. The Group does not enter into or trade

0.78

0.42

in financial instruments, including derivative financial instruments, for speculative purposes.

below). The Group enters into foreign exchange forward contracts to manage its exposure to foreign currency risk of

net imports.

230 The Group’s activities expose it primarily to the financial risk of changes in foreign currency exchange rates (see note E