Page 41 - Annual Report 2019-20

P. 41

39

th

Transfer to Reserves on 13 January 2020 to carry on the business Performance of Major Domestic and Overseas Subsidiaries

of manufacturing, processing and distribution (` in crores)

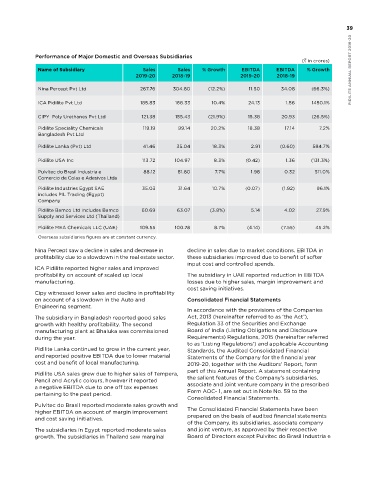

The Company does not propose to transfer amounts of technical mortars and other materials used in Name of Subsidiary Sales Sales % Growth EBITDA EBITDA % Growth

to the general reserve. construction. The Company holds 50% of the 2019-20 2018-19 2019-20 2018-19 PIDILITE ANNUAL REPORT 2019-20

Term Finance paid up share capital and has management

control of PGPML. Nina Percept Pvt Ltd 267.76 304.80 (12.2%) 11.50 34.08 (66.3%)

The Company has no outstanding term loans

(previous year NIL). c. Nina Percept Private Limited (NPPL), subsidiary ICA Pidilite Pvt Ltd 185.83 168.33 10.4% 24.13 1.56 1450.1%

of the Company along with Pidilite Speciality

Capital Expenditure Chemicals Pvt Ltd (PSCB), a step down subsidiary CIPY Poly Urethanes Pvt Ltd 121.38 155.43 (21.9%) 15.38 20.93 (26.5%)

The total capital expenditure during the year was of the Company, has incorporated a company on

th

` 369.03 crores (previous year ` 186.23 crores) 29 January 2020, in Bangladesh namely “Nina Pidilite Speciality Chemicals 119.19 99.14 20.2% 18.38 17.14 7.2%

primarily spent on fixed assets for various Percept (Bangladesh) Pvt Ltd.” to carry on the Bangladesh Pvt Ltd

manufacturing units, offices, laboratories, warehouses business of roofing and waterproofing services in Pidilite Lanka (Pvt) Ltd 41.46 35.04 18.3% 2.91 (0.60) 584.7%

and on information technology. Bangladesh. NPPL holds 99% of the paid up share

capital of Nina Percept (Bangladesh) Pvt. Ltd and

Deposits the balance 1% is held by PSCB. Pidilite USA Inc 113.72 104.97 8.3% (0.42) 1.36 (131.3%)

The Company has not accepted any deposits covered d. The Company alongwith Chetana Expotential Pulvitec do Brasil Industria e 88.12 81.80 7.7% 1.98 0.32 511.0%

under Chapter V of the Companies Act, 2013 during Technologies Pvt Ltd, Bangalore has incorporated Comercio de Colas e Adesivos Ltda

the financial year 2019-20 (previous year NIL). a joint venture company in the name of “Pidilite Pidilite Industries Egypt SAE 35.03 31.64 10.7% (0.07) (1.92) 96.1%

C-Techos Walling Limited” (PCWL) on 5 March includes PIL Trading (Egypt)

th

Subsidiaries

2020, to carry on the business of construction Company

Investment in Subsidiaries of building works or any other structural or Pidilite Bamco Ltd includes Bamco 60.69 63.07 (3.8%) 5.14 4.02 27.9%

architectural work of any kind using C-Techos wall

During the year, investment of ` 146.18 crores technology, manufacturing of ACC panels and Supply and Services Ltd (Thailand)

(previous year ` 61.04 crores) was made in other ancillary products. The Company holds 60%

subsidiaries. Of this, ` 127.08 crores was invested in of the paid up share capital and has management Pidilite MEA Chemicals LLC (UAE) 109.55 100.78 8.7% (4.14) (7.55) 45.2%

domestic subsidiaries and ` 19.10 crores in overseas control of PCWL. Overseas subsidiaries figures are at constant currency.

subsidiaries.

e. The Company has, for operational convenience Nina Percept saw a decline in sales and decrease in decline in sales due to market conditions. EBITDA in

The investments in domestic subsidiaries were in and synergies, entered into a business transfer profitability due to a slowdown in the real estate sector. these subsidiaries improved due to benefit of softer

Madhumala Ventures Pvt. Ltd. (formerly known agreement for acquiring the business of wholly input cost and controlled spends.

as Madhumala Traders Pvt. Ltd.) amounting to owned entity, M/s. Nitin Enterprise (a partnership ICA Pidilite reported higher sales and improved

` 126.47 crores and in newly incorporated subsidiaries firm having two partners, both of which are profitability on account of scaled up local The subsidiary in UAE reported reduction in EBITDA

namely Pidilite Litokol Pvt Ltd (` 0.60 crores) and wholly owned subsidiaries of the Company) on manufacturing. losses due to higher sales, margin improvement and

Pidilite Grupo Puma Manufacturing Ltd (` 0.01 crores). cost saving initiatives.

a slump sale basis for a cash consideration of an Cipy witnessed lower sales and decline in profitability

The investments in overseas subsidiaries were amount not exceeding ` 18.50 crores subject to on account of a slowdown in the Auto and Consolidated Financial Statements

in Pidilite International Pte Ltd., Singapore necessary approvals. The acquisition process is Engineering segment. In accordance with the provisions of the Companies

(` 18.03 crores), Pidilite Chemical PLC, Ethiopia likely to be completed during the financial The subsidiary in Bangladesh reported good sales Act, 2013 (hereinafter referred to as ‘the Act’),

(` 0.75 Crores) and Pidilite Industries Egypt SAE year 2020-21. growth with healthy profitability. The second Regulation 33 of the Securities and Exchange

(` 0.32 crores).

f. Madhumala Ventures Pvt Ltd (formerly known manufacturing plant at Bhaluka was commissioned Board of India (Listing Obligations and Disclosure

During the year as Madhumala Traders Pvt Ltd), a wholly owned during the year. Requirements) Regulations, 2015 (hereinafter referred

subsidiary of the Company, has made three to as ’Listing Regulations’) and applicable Accounting

a. The Company along with Litokol S.p.A, Italy strategic investments in relevant start-ups in the Pidilite Lanka continued to grow in the current year, Standards, the Audited Consolidated Financial

has incorporated a joint venture subsidiary in domain of home décor, furnishings, painting and and reported positive EBITDA due to lower material Statements of the Company for the financial year

the name of “Pidilite Litokol Private Limited” waterproofing aggregating to ` 122.48 crores. cost and benefit of local manufacturing. 2019-20, together with the Auditors’ Report, form

(PLPL) on 7 October 2019 to carry on the With these investments, the Company intends to Pidilite USA sales grew due to higher sales of Tempera, part of this Annual Report. A statement containing

th

business of chemicals epoxy grouts, chemical

the salient features of the Company’s subsidiaries,

PIDILITE ANNUAL REPORT 2019-20 b. The Company alongwith Corporacion Empresarial g. Pursuant to a share purchase agreement executed pertaining to the past period. Form AOC- 1, are set out in Note No. 59 to the

support and collaborate with these start ups for

Pencil and Acrylic colours, however it reported

based products etc. The Company holds 60% of

associate and joint venture company in the prescribed

mutual benefits.

a negative EBITDA due to one off tax expenses

the paid up share capital and has management

control of PLPL.

Consolidated Financial Statements.

with Tenax S.p.A, Italy, the Company acquired

Pulvitec do Brasil reported moderate sales growth and

The Consolidated Financial Statements have been

70% of the share capital of Tenax India Stone

higher EBITDA on account of margin improvement

Grupo Puma S.L., Spain has incorporated a

prepared on the basis of audited financial statements

Products Pvt. Ltd. for a cash consideration of

and cost saving initiatives.

joint venture subsidiary in the name of “Pidilite

of the Company, its subsidiaries, associate company

approx. ` 80 crores. The acquisiton process was

Grupo Puma Manufacturing Limited” (PGPML)

and joint venture, as approved by their respective

The subsidiaries in Egypt reported moderate sales

completed on 28 May 2020.

th

38 growth. The subsidiaries in Thailand saw marginal Board of Directors except Pulvitec do Brasil Industria e