Page 105 - Annual Report 2019-20

P. 105

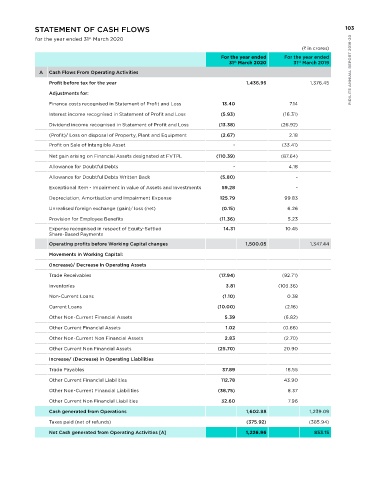

STATEMENT OF CHANGES IN EQUITY STATEMENT OF CASH FLOWS 103

for the year ended 31 March 2020 for the year ended 31 March 2020

st

st

( in crores)

( in crores)

a. Equity Share Capital

For the year ended For the year ended

Amount 31 March 2020 31 March 2019

st

st

Balance as at 1 April 2018 50.78 A Cash Flows From Operating Activities PIDILITE ANNUAL REPORT 2019-20

st

Changes in equity share capital during the year Profit before tax for the year 1,436.95 1,376.45

Issue of equity shares under Employee Stock Option Scheme - 2012 (refer note 46) 0.01

Adjustments for:

Issue of equity shares under Employee Stock Option Plan - 2016* (refer note 46) 0.00

Finance costs recognised in Statement of Profit and Loss 13.40 7.14

st

Balance as at 31 March 2019 50.80

Interest income recognised in Statement of Profit and Loss (5.93) (16.31)

Changes in equity share capital during the year

Issue of equity shares under Employee Stock Option Plan - 2016 (refer note 46) 0.01 Dividend income recognised in Statement of Profit and Loss (13.38) (26.92)

Balance as at 31 March 2020 50.81 (Profit)/ Loss on disposal of Property, Plant and Equipment (2.67) 2.18

st

*Issue of equity shares under Employee Stock Option Plan - 2016 amounts to 48,550 during the year 2018-19. Profit on Sale of Intangible Asset - (33.41)

( in crores) net gain arising on Financial Assets designated at FVTPL (110.39) (87.64)

b. other Equity Allowance for Doubtful Debts - 4.18

Reserves and Surplus ToTAL Allowance for Doubtful Debts Written Back (5.80) -

Capital Securities Capital Cash Share General Retained

Reserve Premium Redem- Subsidy Options Reserve Earnings Exceptional Item - Impairment in value of Assets and Investments 59.28 -

Reserve ption Reserve Outstanding

Reserve Account Depreciation, Amortisation and Impairment Expense 125.79 99.83

Balance as at 1 April 2018 0.34 - 0.50 0.95 9.03 1,335.38 2,166.95 3,513.15 unrealised foreign exchange (gain)/ loss (net) (0.15) 6.26

st

Profit for the year - - - - - - 979.44 979.44

Provision for Employee Benefits (11.36) 5.23

Other Comprehensive Income for the - - - - - - (2.98) (2.98)

year, net of income tax Expense recognised in respect of Equity-Settled 14.31 10.45

Payment of dividends - - - - - - (364.32) (364.32) Share-Based Payments

(including tax thereon) Operating profits before Working Capital changes 1,500.05 1,347.44

Recognition of share-based payments - 10.01 - - 0.62 - - 10.63

(refer Note 46) Movements in Working Capital:

Transferred to Securities Premium on - 10.01 - - (10.01) - - -

Options exercised during the year (Increase)/ Decrease in Operating Assets

Exercised during the year - - - - 1.64 - - 1.64 Trade Receivables (17.94) (92.71)

Amortised during the year - - - - 9.51 - - 9.51 Inventories 3.81 (103.36)

Lapsed during the year - - - - (0.52) - - (0.52)

non-Current Loans (1.10) 0.38

st

Balance as at 31 March 2019 0.34 10.01 0.50 0.95 9.65 1,335.38 2,779.09 4,135.92

Current Loans (10.00) (2.16)

Profit for the year - - - - - - 1,101.62 1,101.62

Other Comprehensive Income for the - - - - - - (11.20) (11.20) Other non-Current Financial Assets 5.39 (6.82)

year, net of income tax

Payment of dividends - - - - - - (826.76) (826.76) Other Current Financial Assets 1.02 (0.66)

(including tax thereon) Other non-Current non Financial Assets 2.83 (2.70)

Recognition of share-based payments - 13.20 - - 1.24 - - 14.44

(refer Note 46) Other Current non Financial Assets (25.70) 20.90

Transferred to Securities Premium on - 13.20 - - (13.20) - - -

Options exercised during the year Increase/ (Decrease) in Operating Liabilities

-

37.89

14.84

14.84

-

18.55

-

-

Amortised and exercised during the year 0.34 23.21 0.50 0.95 (0.40) - - (0.40) Trade Payables 112.78 43.90

-

PIDILITE ANNUAL REPORT 2019-20 In terms of our report attached Managing Director Executive Chairman Other non-Current Financial Liabilities (38.75) 1,602.88 8.37 (385.94)

Lapsed during the year

-

-

-

-

-

Other Current Financial Liabilities

10.89 1,335.38 3,042.74 4,414.01

Balance as at 31 March 2020

st

7.96

Other Current non Financial Liabilities

32.60

For DELOITTE HASKINS & SELLS LLP

FOR AND ON BEHALF OF THE BOARD OF DIRECTORS

Cash generated from Operations

1,239.09

Chartered Accountants

BHARAT PURI

M B PAREKH

N. K. JAIN

(375.92)

Taxes paid (net of refunds)

Partner

DIn: 00180955

DIn: 02173566

PUNEET BANSAL

Chief Financial Officer

102 Place: Mumbai PRADIP KUMAR MENON Company Secretary Net Cash generated from Operating Activities [A] 1,226.96 853.15

Place: Mumbai

th

th

Date: 17 June 2020 Date: 17 June 2020