Page 106 - Annual Report 2019-20

P. 106

STATEMENT OF CASH FLOWS NOTES FORMING PART OF THE 105

for the year ended 31 March 2020 FINANCIAL STATEMENTS

st

( in crores)

1 Corporate information

For the year ended For the year ended

st

st

31 March 2020 31 March 2019 Pidilite Industries Limited, together with its subsidiaries are pioneers in consumer and industrial speciality

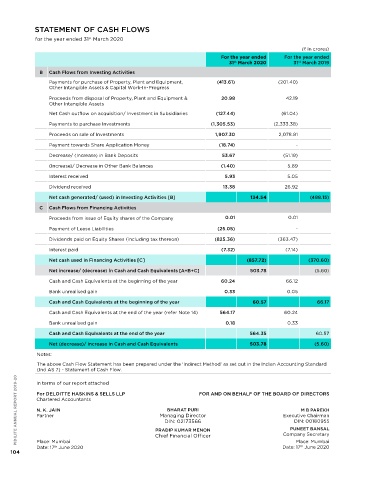

B Cash Flows from Investing Activities chemicals in India. The equity shares of the Company are listed on BSE Ltd (BSE) and national Stock Exchange PIDILITE ANNUAL REPORT 2019-20

of India Ltd (nSE).

Payments for purchase of Property, Plant and Equipment, (413.61) (201.40) The address of its registered office is Regent Chambers, 7 Floor, Jamnalal Bajaj Marg, 208, nariman Point,

th

Other Intangible Assets & Capital Work-In-Progress

Mumbai 400 021. The address of principal place of business is Ramkrishna Mandir Road, Off Mathuradas Vasanji

Proceeds from disposal of Property, Plant and Equipment & 20.98 42.19 Road, Andheri (E), Mumbai 400 059.

Other Intangible Assets

2 Significant Accounting Policies

net Cash outflow on acquisition/ Investment in Subsidiaries (127.44) (61.04)

2.1 Basis of accounting and preparation of financial statements

Payments to purchase Investments (1,305.53) (2,333.38)

The standalone financial statements of the Company have been prepared in accordance with the Indian

Proceeds on sale of Investments 1,907.30 2,078.81 Accounting Standards (“Ind AS”) prescribed under Section 133 of the Companies Act, 2013 (‘Act’) read

with Companies (Indian Accounting Standards) Rules, 2015, as amended.

Payment towards Share Application Money (18.74) -

The financial statements have been prepared under the historical cost convention except for the

Decrease/ (Increase) in Bank Deposits 53.67 (51.19) following items –

(Increase)/ Decrease in Other Bank Balances (1.40) 5.89 a. Certain Financial Assets/ Liabilities (including derivative instruments) – at Fair value

Interest received 5.93 5.05 b. Employee Stock Options - at Fair value

The financial statements are presented in Indian Rupees (InR) and all values are rounded to the nearest

Dividend received 13.38 26.92 crores, except otherwise indicated.

Net cash generated/ (used) in Investing Activities [B] 134.54 (488.15) 2.2 Business Combination

C Cash Flows from Financing Activities Acquisitions of businesses are accounted for using the acquisition method. The consideration transferred

in a business combination is measured at fair value, which is calculated as the sum of the acquisition-

Proceeds from issue of Equity shares of the Company 0.01 0.01 date fair values of the assets transferred by the Company, liabilities incurred by the Company to the

former owners of the acquiree and the equity interest issued by the Company in exchange of control of

Payment of Lease Liabilities (25.05) - acquiree. Acquisition-related costs are recognised in profit or loss as incurred.

Dividends paid on Equity Shares (including tax thereon) (825.36) (363.47) When the consideration transferred by the Company in a business combination includes assets or

liabilities resulting from a contingent consideration arrangement, the contingent consideration is

Interest paid (7.32) (7.14)

measured at its acquisition-date fair value and included as a part of the consideration transferred

Net cash used in Financing Activities [C] (857.72) (370.60) in a business combination. Changes in the fair value of the contingent consideration that qualify as

measurement period adjustments are adjusted retrospectively, with corresponding changes against

Net increase/ (decrease) in Cash and Cash Equivalents [A+B+C] 503.78 (5.60) goodwill or capital reserve, as the case maybe. Measurement period adjustments are adjustments that

arise from additional information obtained during the ‘measurement period’ (which cannot exceed

Cash and Cash Equivalents at the beginning of the year 60.24 66.12 one year from the acquisition date) about facts and circumstances that existed at the acquisition

date. Contingent consideration that is classified as an asset or a liability is subsequently (after the

Bank unrealised gain 0.33 0.05

measurement period) remeasured at subsequent reporting dates with the corresponding gain or loss

Cash and Cash Equivalents at the beginning of the year 60.57 66.17 being recognised in Statement of Profit and Loss.

In case of business combinations involving entities under common control, the above policy does

Cash and Cash Equivalents at the end of the year (refer note 14) 564.17 60.24

not apply. Business combinations involving entities under common control are accounted for using

Bank unrealised gain 0.18 0.33 the pooling of interests method. The net assets of the transferor entity or business are accounted

at their carrying amounts on the date of the acquisition subject to necessary adjustments required

Cash and Cash Equivalents at the end of the year 564.35 60.57 to harmonise accounting policies. Retained earnings appearing in the financial statements of the

transferor is aggregated with the corresponding balance appearing in the financial statements of the

Net (decrease)/ increase in Cash and Cash Equivalents 503.78 (5.60) transferee. Identity of the reserves appearing in the financial statements of the transferor is preserved

notes: and appears in the financial statements of the transferee in the same form. Any excess or shortfall of the

consideration paid over the share capital of transferor entity or business is recognised as capital reserve

The above Cash Flow Statement has been prepared under the ‘Indirect Method’ as set out in the Indian Accounting Standard under equity.

(Ind AS 7) - Statement of Cash Flow.

2.3 Goodwill

PIDILITE ANNUAL REPORT 2019-20 For DELOITTE HASKINS & SELLS LLP PRADIP KUMAR MENON Executive Chairman on an acquisition of a business is carried at cost as established at the date of acquisition of the business

Goodwill is measured as the excess of the sum of the consideration transferred over the net of

In terms of our report attached

acquisition-date amounts of the identifiable assets acquired and the liabilities assumed. Goodwill arising

FOR AND ON BEHALF OF THE BOARD OF DIRECTORS

less accumulated impairment losses, if any.

Chartered Accountants

For the purposes of impairment testing, goodwill is allocated to each of the Company’s cash-generating

N. K. JAIN

BHARAT PURI

M B PAREKH

units (or groups of cash-generating units) that is expected to benefit from the synergies of the

Managing Director

Partner

combination. A cash-generating unit to which goodwill has been allocated is tested for impairment

DIn: 00180955

DIn: 02173566

annually, or more frequently when there is an indication that the unit may be impaired. If the recoverable

PUNEET BANSAL

to reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the

Place: Mumbai

Place: Mumbai

unit pro-rata based on the carrying amount of each assets in the unit. Any impairment loss for goodwill

Date: 17 June 2020

th

th

Date: 17 June 2020 Chief Financial Officer Company Secretary amount of the cash-generating unit is less than its carrying amount, the impairment loss is allocated first

104 is recognised directly in Statement of Profit and Loss. An impairment loss recognised for goodwill is not

reversed in subsequent periods.