Page 25 - Annual Report 2019-20

P. 25

PERFORMING 23

key performance indicators (standalone)

23

PIDILITE ANNUAL REPORT 2019-20 PIDILITE ANNUAL REPORT 2019-20

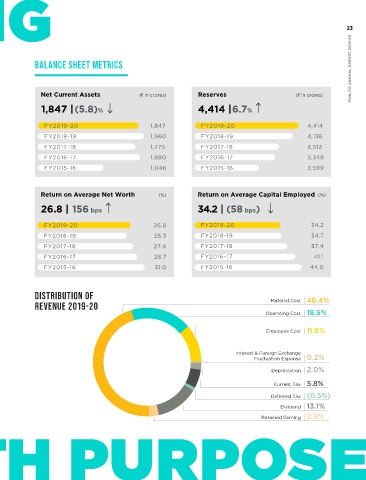

PROFIT AND LOSS METRICS BALANCE SHEET METRICS

Net Sales (` in crores) EBITDA (` in crores) Net Current Assets (` in crores) Reserves (` in crores)

6,290 | 4.0% 1,485 | 14.4% 1,847 | (5.8)% 4,414 | 6.7%

FY2019-20 6,290 FY2019-20 1,485 FY2019-20 1,847 FY2019-20 4,414

FY2018-19 6,047 FY2018-19 1,298 FY2018-19 1,960 FY2018-19 4,136

FY2017-18 5,309 FY2017-18 1,294 FY2017-18 1,775 FY2017-18 3,513

FY2016-17 4,837 FY2016-17 1,229 FY2016-17 1,880 FY2016-17 3,348

FY2015-16 4,703 FY2015-16 1,121 FY2015-16 1,046 FY2015-16 2,599

Profit After Tax (` in crores) Earnings Per Share (EPS) ( ` ) Return on Average Net Worth (%) Return on Average Capital Employed (%)

(excluding exceptional items)

1,161 | 18.5% 22.8 | 18.1% 26.8 | 156 bps 34.2 | (58 bps)

FY2019-20 1,161 FY2019-20 22.8 FY2019-20 26.8 FY2019-20 34.2

FY2018-19 979 FY2018-19 19.3 FY2018-19 25.3 FY2018-19 34.7

FY2017-18 955 FY2017-18 18.8 FY2017-18 27.4 FY2017-18 37.4

FY2016-17 868 FY2016-17 16.9 FY2016-17 28.7 FY2016-17 41.1

FY2015-16 774 FY2015-16 15.1 FY2015-16 31.0 FY2015-16 44.0

Book Value Per Share ( ` ) Dividend Per Share (DPS) ( ` ) Distribution of Material Cost 46.4%

87.9 | 6.7% 7.00* | 7.7% Revenue 2019-20 Operating Cost 18.5%

FY2019-20 87.9 FY2019-20 7.00*

Employee Cost 11.6%

FY2018-19 82.4 FY2018-19 6.50

FY2017-18 70.2 FY2017-18 6.00

Interest & Foreign Exchange

FY2016-17 66.3 FY2016-17 4.75 Fluctuation Expense 0.2%

FY2015-16 51.7 FY2015-16 4.15 Depreciation 2.0%

PIDILITE ANNUAL REPORT 2019-20 PIDILITE ANNUAL REPORT 2019-20 Retained Earning 2.9%

Current Tax 5.8%

*interim dividend considered as final dividend for FY 2019-20

Deferred Tax (0.5%)

Dividend 13.1%

Y-O-Y Growth/Degrowth WITH PURPOSE

22

22